What Is Yield Farming in Crypto? A Complete Beginner’s Guide

Yield farming lets crypto holders bank passive income lending assets to DeFi platforms in exchange for rewards. You're putting your money to work instead of letting it sit idle, except the "bank" is a smart contract and the interest rates can swing anywhere from 1% to 100%+ annually.

The Wild West days are mostly over. Early yield farming was a chaotic gold rush where 1000% APYs masked Ponzi tokenomics, and exit scams lurked behind every attractive pool. These days, the space has grown up - somewhat.

Total value locked across DeFi still runs into the hundreds of billions, with battle-tested platforms like Aave, Compound, Curve, and Uniswap dominating.

But the real action is happening in newer areas: liquid staking derivatives that let you earn while your ETH is staked, and real-world asset integration that's bringing traditional finance yields on-chain.

The question isn't whether yield farming works; it clearly does for millions of users. The question is, are you prepared to do the homework before jumping into pools promising eye-popping returns?

Quick Takeaways: What You'll Learn About Yield Farming

What yield farming actually is and why protocols pay you to use their platforms

How to tell the difference between sustainable yields and token-printing schemes

The mechanics behind liquidity pools, lending protocols, and reward systems

Which platforms offer genuine opportunities vs. which ones are exit scam bait

How to spot red flags before depositing your hard-earned crypto

Risk management strategies that keep you farming instead of getting rekt

Why most people lose money yield farming (and how to avoid being one of them)

Yield Farming Explained

The concept sounds simple enough: deposit your crypto into a protocol, earn rewards, repeat. But yield farming's evolution from experimental DeFi mechanism to multi-billion dollar industry reveals how quickly things can go from "revolutionary" to "completely unhinged" and back again.

What Is Yield Farming?

Link Alt text: Crypto yield farming blue gradient concept icon

Yield farming means submitting your cryptocurrency to decentralized finance protocols in exchange for rewards. You're essentially becoming a liquidity provider - supplying the assets that make DeFi trading, lending, and borrowing possible.

The term "farming" comes from the agricultural metaphor of cultivating crops, but the mechanics are purely financial. You deposit tokens into liquidity pools, and smart contracts distribute rewards based on your contribution. When done right, you can withdraw your original deposit plus whatever yield you’ve accumulated along the way.

From DeFi Summer to Hard Lessons

Yield farming first went mainstream in 2020’s “DeFi Summer,” when Compound Finance introduced its COMP token rewards. Users realized they could actually make more from the free governance tokens than from the underlying interest rates, creating the first true “liquidity mining” craze.

What followed was a blur of projects competing for attention by dangling APYs that looked like typos - 500%, 1,000%, even higher. It’s no surprise that most of these protocols collapsed as soon as token rewards dried up or their smart contracts were exploited. “Vampire attacks,” where new protocols lured away liquidity from competitors with juicier rewards, became a recognized business model.

The 2021 bull run turned yield farming into a casino where everyone thought they were the house. Then 2022 arrived with Terra/Luna's spectacular implosion and a parade of protocol failures that reminded everyone why "risk-free yield" doesn't exist.

The survivors learned to focus on generating real yield from trading fees, lending spreads, and actual economic activity rather than printing tokens into oblivion. Today's yield farming trades the lottery-ticket mentality for something approaching sustainability - though "approaching" does a lot of work in that sentence.

But compared to the Ponzi-fueled chaos of 2020, today’s yield farming, thankfully, looks more like a maturing industry than a get-rich-quick scheme.

How Yield Farming Differs from Traditional Finance

On the surface, yield farming looks a lot like a savings account: you deposit money and expect interest in return. But under the hood, the mechanics and the risks are completely different.

Feature | Traditional Savings | Yield Farming |

Where you deposit | Bank account | DeFi platform |

Who manages funds | Bank lends/invests on your behalf | Smart contracts allocate liquidity automatically |

Typical returns | ~0.6% APY (average); up to 4–5% with high-yield options | 3%–20%+ APY (higher in experimental pools) |

Risk profile | Low | Higher |

Intermediaries | Centralized institution | Peer to peer |

Protection | FDIC/NCUA insurance | None - on the individual |

Traditional savings accounts work because banks use your deposits to make loans, invest, and generate profit. In return, they hand you a tiny slice of that profit, usually less than 1% APY in most developed economies. You’re trusting a centralized institution, protected (to some extent) by insurance and regulation.

Yield farming, on the other hand, cuts out the bank. You deposit crypto directly into decentralized platforms, be it a lending pool on Aave or a liquidity pool on Uniswap, and smart contracts automatically distribute rewards.

With no middlemen, the returns can be far higher, often in the 3%–20% range for established pools, and much higher for experimental ones.

The differences don’t stop there:

No bankers, only code: Smart contracts, not humans, decide how funds are allocated and rewards distributed. If the code works as intended, everything runs smoothly. If there’s a bug, your funds may be gone in seconds.

Always on: Traditional banks close at 5 PM and on weekends. DeFi runs 24/7 across global markets, with yields updating in real time.

Risk vs. reward: Higher potential returns also mean higher risks. There’s no FDIC insurance in DeFi, so if a platform fails or gets hacked, you’re on your own.

In short, yield farming removes intermediaries and hands you the rewards, but it also hands you all the responsibility.

How Yield Farming Powers DeFi

While individual investors earn passive income from yield farming, they also maintain decentralized finance. Every time you deposit tokens into a pool, you’re not only chasing returns; you’re supplying the liquidity that powers the entire DeFi machine.

DEXs depend on liquidity providers. Without your deposits, there are no token swaps, and traders would be stuck with massive slippage or no market at all.

Lending and borrowing protocols such as Aave and Compound rely on user deposits. Lenders earn interest, borrowers access capital, and the system only works because liquidity providers take the first step.

Stablecoin markets thrive on yield farming pools. Pairings like USDC/USDT or DAI/USDC allow traders to move large sums with minimal price impact while providing consistent yields for farmers.

In other words, yield farming isn’t a side hustle grafted onto crypto; it’s the plumbing. Without it, DeFi’s “money legos” collapse. The same mechanism that lets you earn 5% on different stablecoins is what makes 24/7 decentralized trading, lending, and staking even possible.

That dual role makes yield farming so powerful; it’s both an investment strategy and the foundation on which DeFi itself stands.

How Yield Farming Works

Yield farming is fairly simple, but the devil is in the details. Choosing the right pool and knowing what the risks are is what separates profitable yield farmers from the rest.

The Basic Mechanics

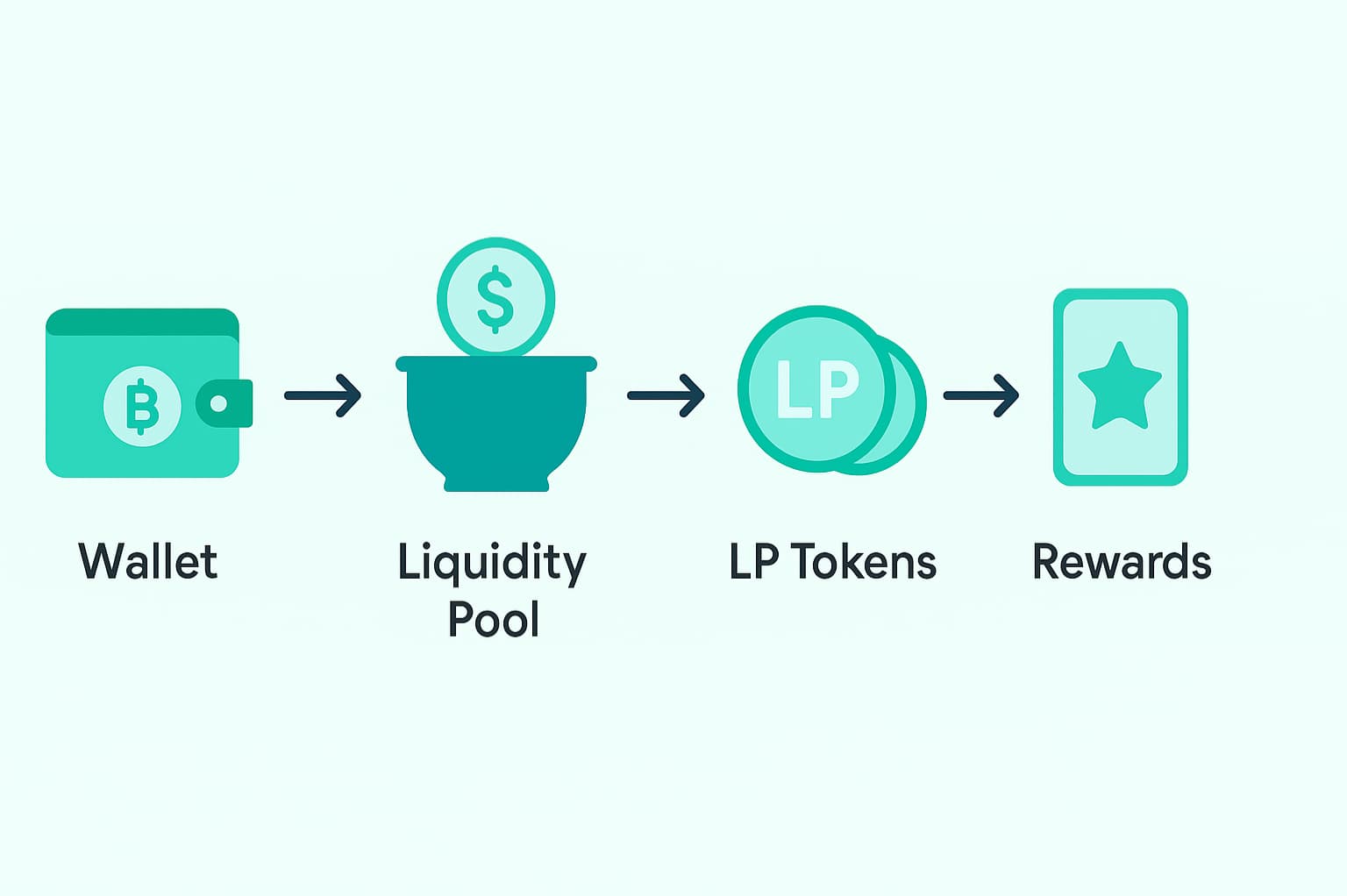

Most yield farming involves offering up some of your crypto to DeFi platforms that need liquidity. You deposit assets, and they give you some kind of receipt token, and you earn rewards over time.

For liquidity pools on platforms like Uniswap, you deposit two tokens of equal value - say $500 of ETH and $500 of USDC. The protocol gives you LP tokens representing your share of the pool. When people trade using your liquidity, you earn a cut of the fees.

For lending platforms like Aave, you simply deposit tokens and start earning interest from borrowers. No pairs required, no LP tokens - just straightforward lending.

Some protocols also shower you with their governance tokens as extra incentives. Curve gives out CRV, Aave distributes AAVE tokens, and newer protocols often use token rewards to attract early users.

Types of Yield Farming Strategies

Yield farming strategies carry varying degrees of risk. Understanding the spectrum helps you choose approaches that match your risk tolerance and experience level.

Conservative Strategies (Lower Risk)

Stablecoin Farming: USDC/USDT pairs minimize impermanent loss risk since both tokens maintain similar values. Curve Finance built an empire on boring stablecoin swaps because sometimes boring actually works.

Blue-Chip Token Pairs: ETH/WBTC combinations on established platforms provide exposure to major blue-chip cryptocurrencies while reducing impermanent loss (more about that later) compared to more volatile pairs. Less exciting than hunting for the next 100x gem, but also less likely to zero your portfolio.

Single-Asset Lending: Supply tokens to platforms like Aave or Compound (3-4% APY on USDC) for straightforward interest earning without liquidity pool complexity.

Moderate Risk Strategies

Major Altcoin Pairs: ETH/LINK or BNB/CAKE combinations offer higher returns while betting on projects that might actually survive the next bear market.. Impermanent loss risk increases with token volatility.

Governance Token Staking: Earn platform tokens by staking protocol tokens. Curve's vote-escrowed CRV system allows earning 5-7% APY plus voting power over protocol decisions.

Cross-Chain Bridging: Provide liquidity for asset transfers between blockchains. Higher rewards often compensate for additional smart contract and bridge risks.

High Risk, High Reward Strategies

New Project Tokens: Many projects fail spectacularly, some turn out to be elaborate rug pulls, and a tiny few make early farmers ridiculously wealthy.

Leveraged Positions: Borrowing to increase farming exposure amplifies both gains and losses. Liquidation risk makes this strategy unsuitable for beginners.

Experimental Protocols: These Unaudited smart contracts usually come with attractive rewards but may also hide serious vulnerabilities. High yields frequently compensate for high risks.

Those conservative strategies might feel boring until you watch leveraged farmers get liquidated during market volatility. Sometimes, boring keeps you in the game long enough to actually profit.

Yield Farming Risks: What Can Go Wrong

Yield farming's risks can be catastrophic for unprepared participants. Here's what actually goes wrong in practice.

Impermanent Loss Explained

You've probably heard "impermanent loss" bandied about as one of yield farming's biggest gotchas. It happens when the prices of tokens in your liquidity pool start moving in different directions.

Say you provide ETH/USDC liquidity and ETH doubles in price. You'd actually end up with less ETH than if you'd just held it in your wallet. If one token doubles, you lose about 5.7% compared to holding. If it triples, you're down 13.4%. The bigger the price gap gets, the more painful it becomes.

Your best bet for avoiding this is sticking with correlated assets like stablecoin pairs, finding protocols that offer single-sided staking, or just accepting lower yields.

Smart Contract and Platform Risks

Smart contract bugs can permanently wipe out your funds. Even audited protocols aren't bulletproof. Audits miss edge cases all the time, and new protocol updates can introduce fresh vulnerabilities.

Platform hacks and exploits continue plaguing DeFi, with billions lost annually. Reentrancy attacks, flash loan exploits, and oracle manipulation remain common attack vectors that can drain protocol funds overnight.

Unaudited protocols are basically asking you to be their unpaid security tester. Before putting serious money anywhere, you'll want to do some homework.

Liquidity Risks

Those eye-popping APY rates in most instances will signal either high risk or unsustainable tokenomics. Sometimes the tokens you're earning lose value faster than you can accumulate them, leaving you with negative real returns despite seeing your token balance grow.

Then there's liquidity risk. There’s always the chance you can't actually withdraw your funds when you need them. Some protocols implement withdrawal delays or exit fees that can trap your capital right when markets are getting volatile and you want out most.

Getting Started: Your First Yield Farming Experience

Want to dip your toes in the yield farming waters without losing your shirt? Here’s how:

Prerequisites and Setup

Get your wallet sorted. You'll need MetaMask or another Web3 wallet that can interact with DeFi protocols. Set up two-factor authentication and write down your seed phrase somewhere safe - not on your computer.

Fund your account strategically. You need the native token for gas fees on whatever blockchain you're using. You'll also need whatever tokens you plan to farm with. Start with more gas tokens than you think you'll need because costs can spike during network congestion.

Research before you leap. For your first attempts, stick with established platforms like Uniswap, Curve, or Aave, but consider starting on cheaper networks like Arbitrum, where gas fees won't affect small positions as much.

Step-by-Step First Farm

Here's a practical walkthrough using a conservative approach:

Pick a stablecoin pair like USDC/USDT to minimize impermanent loss risk

Connect your wallet to your chosen platform - you'll see a "Connect Wallet" button somewhere prominent

Approve token spending - this requires separate transactions for each token type and costs gas each time

Add liquidity to the pool by depositing equal dollar amounts of both tokens

Receive LP tokens as proof of your pool ownership

Monitor your position without obsessing over every price tick

You'll start earning trading fees immediately, though the amounts might seem tiny at first. Some platforms let you stake your LP tokens for additional rewards.

Portfolio Management and Scaling

Start small enough that losing everything would be educational rather than devastating. You're paying for lessons in how DeFi actually works, not trying to get rich on your first attempt.

Diversification. Spread your risk across different platforms and strategies rather than going all-in on one opportunity. If one protocol gets exploited, you won't lose everything.

Monitor your positions regularly, but avoid the temptation to tinker constantly. Set up price alerts instead of checking manually every few hours. This prevents you from making emotional decisions based on short-term market movements.

Decide on your exit strategy early. Will you reinvest rewards for compound growth or take profits regularly? Your approach should depend on market conditions and your personal financial goals, not on whether you're currently winning or losing.

Yield Farming as Part of Your Crypto Strategy

Yield farming may no longer be the gold rush it once was, but it remains a cornerstone of the DeFi economy. Done carefully, it can transform idle assets into a steady income stream while giving you a front-row seat to how decentralized finance really works.

Yield farming works, but it's not a get-rich-quick scheme. If you're going to try it, start boring. Stablecoin farming on Curve might only give you 8% APY, but you'll still have your money at the end of the year.

If you’re ready to keep building your knowledge, take your next step in crypto with the right mix of AI-powered learning, smart tools, and community support - all in one place at LearningCrypto.

Frequently Asked Questions

How are yield farming returns calculated?

Returns come from trading fees, lending interest, and token rewards. APY assumes constant reinvestment and current token prices.

How does yield farming differ from staking?

Staking secures blockchain networks for annual rewards with locked tokens. Yield farming provides DeFi liquidity.

Are yield farming rewards taxable?

In most jurisdictions, yes. When earned, rewards are usually considered taxable income, and additional tax may apply when converting or selling them. Always check local regulations.

What is “auto-compounding” in yield farming?

Auto-compounding is when a protocol or third-party service automatically reinvests your farming rewards back into the pool, growing your position without manual intervention.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.