Coinbase vs Binance: Which Crypto Exchange Is Right for You?

TL;DR Coinbase excels in simplicity and U.S. regulatory compliance, making it ideal for beginners who prioritize straightforward interfaces and are willing to pay higher fees. Binance Global dominates with over 500 coins and low fees, but U.S. traders are limited to Binance.US, a watered-down version with fewer coins, no futures trading, and availability in only 36 states.

When people first start getting involved in crypto, one of the earliest decisions they face is what exchange to choose. With the two biggest players being Coinbase and Binance, it’s normally a decision between these two giants.

Coinbase built its reputation as the "safe choice." It’s publicly traded, fully licensed, and designed for those who value simplicity.

Binance has gotten more structured after its 2023 compliance overhaul and CEO transition. It remains the world’s largest exchange by volume, offering everything to everyone.

But if you're in the U.S., you're not getting the real Binance. You're getting Binance.US, a regulatory-compliant shell of its global counterpart.

What You’ll Learn in This Comparison

✔ The differences between Coinbase, Binance, and Binance.US

✔ The beginner-friendly features each exchange offers (and which ones are genuinely useful)

How wallets, staking, and DeFi access compare between the two

✔ Security track records - past breaches, insurance coverage, and cold storage practices

✔ When using both exchanges makes more sense than picking just one

Binance and Binance.US: What U.S. Traders Need to Know

To avoid any confusion from the outset, let's clarify the distinct differences between Binance and Binance.US. They are not the same.

Because of U.S. regulations, the main Binance.com exchange isn't available to American users. It offers stripped-down features and is unavailable in 14 states, including New York, Texas, and Hawaii.

Essentially, Binance.com is a full-powered international exchange, while Binance.US is its compliance-restricted counterpart, designed for American regulations.

When this guide mentions "Binance," we're talking about the global platform unless specified otherwise. If you're in the U.S., assume you're limited to Binance.US’s features.

Exchange Overview: Coinbase vs Binance at a Glance

Feature | Coinbase | Binance Global | Binance US |

Founded | 2012 | 2017 | 2019 |

Headquarters | United States | Decentralized (licensed in 20+ countries) | United States |

Regulation | Licensed in 50 U.S. states, UK VASP, EU approval | Multi-jurisdictional; under monitorship | FinCEN-registered MSB. Available in 36 states |

Users (est.) | 100 M + | 275 M | ~2 M active |

Cryptocurrencies | 500+ | 300+ | 150+ |

Best For | Beginners, U.S. investors | Experienced global traders | U.S. traders needing compliance |

Coinbase Overview

Coinbase has been around since 2012, making it one of the crypto industry's old guard. It went public on NASDAQ in 2021 under the ticker COIN, making it the first major crypto exchange to trade on a traditional stock market.

The exchange operates with licenses in nearly all 50 U.S. states, holds VASP approval in the UK, and has received regulatory clearance across the EU. This regulatory framework isn't just for show. In early 2025, the SEC dropped its case against Coinbase, removing a cloud of uncertainty that had hung over the company for years.

Coinbase built its reputation on being the easy option. The interface doesn't assume you know what a limit order is. Educational content through Coinbase Learn walks beginners through crypto basics.

It supports over 300 cryptocurrencies, though it's pickier about listings than competitors. Coin listings go through compliance vetting before they show up in the exchange.

Coinbase holds custody for several U.S. spot Bitcoin ETFs and maintains more than $9 billion in reserves. For Americans who want regulatory protection and don't mind paying a bit extra for peace of mind, it remains the default choice.

Read our Ultimate Guide to Coinbase here

Binance Overview

Binance launched in 2017 and grew faster than any exchange in crypto history. It became the largest exchange by trading volume with over 500 cryptocurrencies, futures, margin trading, staking, an NFT marketplace, and its own blockchain.

That growth hasn’t been all smooth sailing, though. In 2023, Binance settled money laundering charges with U.S. authorities. Founder Changpeng Zhao (known as CZ) resigned as part of the deal, and former compliance chief Richard Teng took over as CEO.

The SEC also came after Binance, although that case got dismissed in May 2025. The company still operates under a multi-year compliance monitorship.

Binance doesn't have a traditional headquarters. Instead, it runs licensed entities across Asia, Europe, and the Middle East. This includes operations run out of Japan, France, and the UAE.

It's also pulled out of several markets, exiting the UK in 2023, along with Canada and the Netherlands, for various regulatory reasons.

The upside to Binance’s regulatory issues is lower fees than Coinbase (0.1% vs 1-3%) and access to far more cryptocurrencies.

Features Comparison Between Coinbase and Binance

Now that you know the basics about each one, let's see what actually separates them. The devil's in the details here; fees, coin selection, interface design, and security all play a role in determining which exchange works better for you.

Trading Fees and Costs

Fees matter more than most beginners realize. A 2% difference might seem small on a $100 purchase, but once you're moving serious money or trading frequently, those percentages become real dollars fast.

Coinbase Fee Structure

Coinbase runs two different pricing models depending on which part of the platform you use. The standard Coinbase interface charges around 1.49% for bank transfers and higher for debit or credit card purchases (often 3.99%). On top of that, there's a spread fee of roughly 0.50% baked into the price.

Coinbase Advanced (which replaced Coinbase Pro) offers much better rates. Fees start at 0.60% for makers and takers under $10,000 in monthly volume, dropping to 0.40% once you hit that threshold. Heavy traders can get down to 0.05% if they're moving over $500 million monthly, though that's not relevant for most people.

There's also Coinbase One, a $29.99/month subscription that eliminates trading fees on purchases up to $10,000 per month.

Binance Fee Structure

Binance Global starts at 0.1% for both maker and taker orders on spot trading. Use BNB (Binance's token) to pay fees, and that drops to 0.075%. VIP tiers bring fees down even further based on your 30-day trading volume and BNB holdings.

For futures trading, regular users pay 0.02% maker fees and 0.05% taker fees. Higher VIP levels can get maker fees down to 0.00% and taker fees to 0.017%.

Binance.US has an even more aggressive fee structure: 0% maker fees and 0.01% taker fees for all customers, no subscription required.

Fee Comparison at a Glance | |||||

|---|---|---|---|---|---|

Trade Amount | Coinbase Standard | Coinbase Advanced | Coinbase One | Binance Global | Binance.US |

$100 | ~$2.00 | ~$0.60 | $0* | ~$0.10 | ~$0.01 |

$1,000 | ~$20.00 | ~$6.00 | $0* | ~$1.00 | ~$0.10 |

$10,000/month | ~$200 | ~$40-60** | $29.99*** | ~$10 | ~$1.00 |

*Requires $29.99/month subscription, covers up to $10,000 in trades

**Depends on volume tier (0.60% under $10K, 0.40% over $10K)

***Subscription fee, unlimited trades up to $10,000/month

The table makes it clear: Binance wins on fees for almost every scenario. Coinbase One can compete if you're consistently trading near the $10,000 monthly limit.

Available Cryptocurrencies and Trading Pairs

How many coins do you actually need access to? If you're buying Bitcoin and calling it a day, both platforms work fine. But if you want to chase the latest DeFi token or catch a new project before it explodes, the selection gap between these two widens fast.

Coinbase Selection

Coinbase lists over 300 cryptocurrencies as of 2025. The main exchange has 315 coins with 460 trading pairs. They added 21 new ones in Q2 2025 alone and planned for 50-80 more throughout the year.

Coinbase's approach for new coins is that they're picky. Every coin goes through compliance vetting and regulatory review before it shows up on the platform. This means slower listings, but also fewer rug pulls and scam tokens making it through.

You won't find every hyped altcoin the day it launches. What you will find has been screened more carefully. For people who'd rather avoid getting wrecked by a token that disappears overnight, that trade-off makes sense.

Trading pairs lean heavily toward fiat currencies USD, EUR, GBP, and major cryptos like Bitcoin and Ethereum. Want to swap one obscure altcoin directly for another? You'll probably need to convert to USD or a stablecoin first, which means an extra transaction and fee.

Binance Selection

Binance Global sits at over 500 cryptocurrencies with more than 1,500 trading pairs. We're talking established coins, brand-new DeFi projects, meme tokens, and random experiments - pretty much everything.

The platform updated its listing system in recent years to filter out obvious garbage, but tokens still get added constantly. The vetting is looser than Coinbase's. That means faster access to new projects, but also higher risk of pumps, dumps, and outright scams.

Binance also runs an NFT marketplace, supports tons of DeFi tokens, and offers early access to projects through Binance Launchpad before they hit other exchanges. If there's a new crypto project making noise on X, it'll probably show up on Binance weeks or months before Coinbase considers listing it.

Binance.us gets around 150 cryptocurrencies because of U.S. regulations. Still more than many American exchanges, but nowhere close to what global users get.

Trading Pairs and Liquidity

Binance crushes Coinbase on crypto-to-crypto pairs. Want to trade one altcoin directly for another without touching USD? Binance has hundreds of these pairs with solid liquidity.

Coinbase keeps it simpler. You'll find what you need for Blue Chips. But for niche coins, you're converting to fiat or stablecoins first. Extra step, extra fee.

If you're hunting for obscure altcoins or day-trading between different tokens, Binance's deeper liquidity results in better prices and faster fills.

User Interface and Experience

The interface is where Coinbase and Binance split into completely different philosophies. Coinbase wants you to be comfortable. Binance wants you to be powerful.

Coinbase Interface

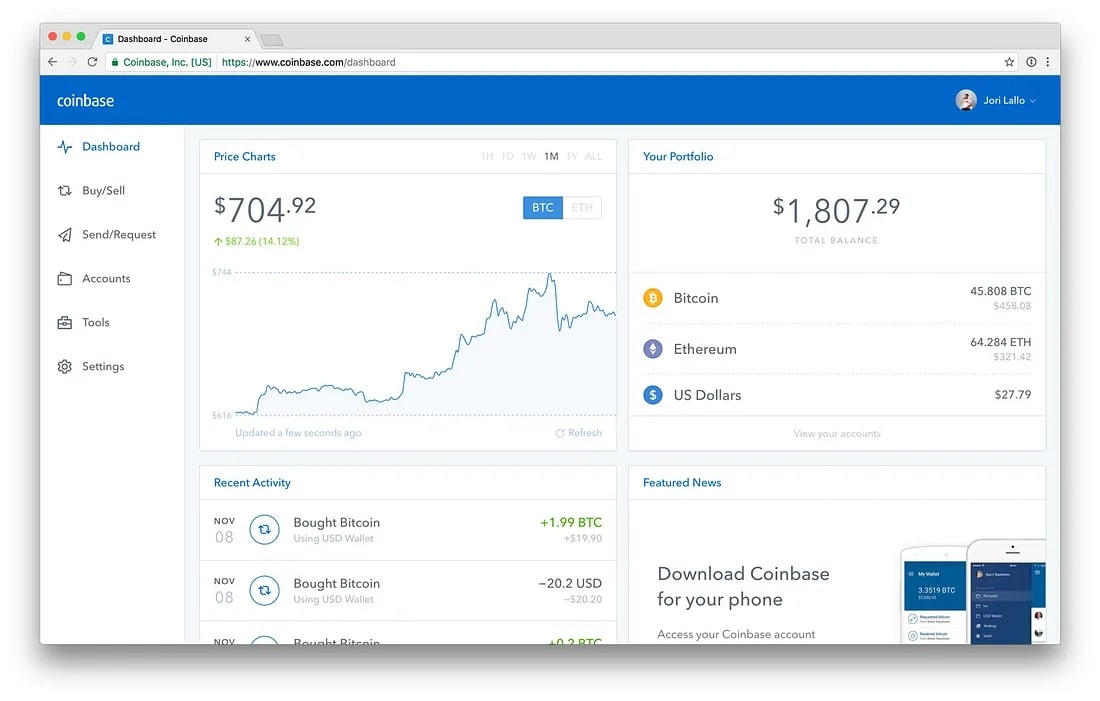

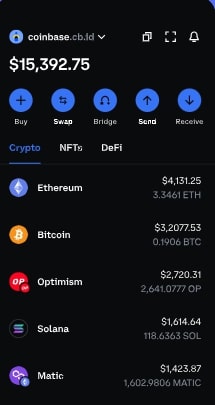

Image via Coinbase

Coinbase built its platform for people who've never touched crypto before. Open the app, and you get big buttons, clear labels, and almost no jargon. Want to buy Bitcoin? Tap Bitcoin, enter an amount, hit buy. Done.

The mobile app especially nails this approach. One-click purchases for major cryptocurrencies, a portfolio view that shows your total holdings without overwhelming you with data, and educational content built right into the interface through Coinbase Learn.

For anyone who wants more control, there's Coinbase Advanced Trade. This gives you proper charting tools, different order types (limit, stop-loss, etc.), and a real trading interface. It's not as simple as the standard app, but it's still cleaner than most competing platforms.

Image via Coinbase

The downside? If you're experienced and want maximum customization, Coinbase can feel limiting. The interface prioritizes clarity over options, which works great for beginners but can frustrate traders who know exactly what they want.

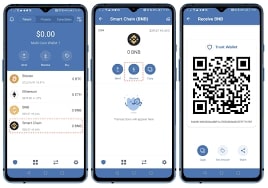

Binance Interface

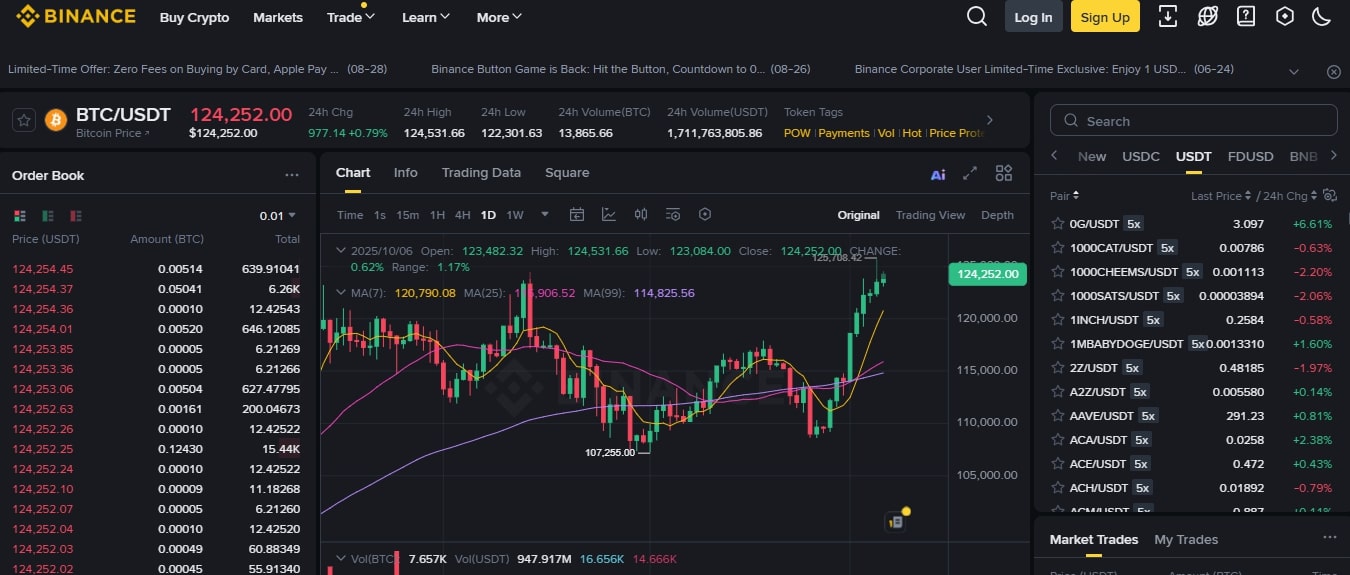

Binance throws everything at you from day one. Multiple trading views, advanced charting tools, dozens of order types, futures tabs, margin options, staking menus - it's a lot.

Image via Binance

The global platform gives you total customization. Want to rearrange widgets, set up custom indicators, or switch between different chart types? Go ahead. Need to see your spot balance, futures positions, and staking rewards all on one screen? Binance lets you do it.

The problem is obvious: new users get lost immediately. The learning curve is steep. Even basic spot trading requires understanding which menu to click, what order type to use, and how to avoid accidentally opening a leveraged position.

Binance upgraded its mobile app recently with smart widgets and theme customization, trying to make things more approachable. It helps, but the app still assumes you know your way around crypto trading.

The Difference

Coinbase optimizes for "I want to own some Bitcoin without thinking too hard about it." Binance optimizes for "I want every possible tool to execute complex trading strategies."

If you're starting out, Coinbase won't make you feel stupid. If you're experienced and want full control, Binance gives you everything you could need and then some.

Neither approach is wrong. They're just built for different people.

Security and Safety Measures

Crypto has come a long way from the Wild West days when exchanges collapsed overnight and took everyone's money with them. These days, security isn't optional; it's the baseline. Both platforms take protecting user funds seriously, but their approaches and track records tell different stories.

Security Comparison | |||

|---|---|---|---|

Security Feature | Coinbase | Binance Global | Binance.us |

Cold Storage | ≈ 98 % of assets offline | Majority in cold wallets | Same policy as parent |

Insurance | FDIC for USD deposits ($250K) | SAFU emergency fund | Limited disclosure |

2FA / Biometrics | Yes | Yes | Yes |

Security Audits | SOC 1 & SOC 2 Type II | Ongoing third-party audits | Limited disclosure |

Regulatory Oversight | High (U.S. licensed) | Moderate (multi-jurisdiction) | Fairly high (U.S. FinCEN) |

Coinbase Security

Coinbase keeps 98% of user funds in offline cold storage—disconnected from the internet and out of reach of hackers. The remaining 2% sits in hot wallets to handle daily withdrawals and operations.

For USD deposits, Coinbase says funds in linked bank accounts may be FDIC-insured up to $250,000. The catch: cryptocurrency itself isn't FDIC-insured. Only the dollars sitting in your account before you buy crypto get that protection.

The platform carries commercial crime insurance for digital assets and maintains SOC 1 Type II and SOC 2 Type II audits through Deloitte & Touche for custody operations. These audits verify that Coinbase follows institutional-grade security protocols.

A 2025 data breach raised questions about how effective SOC 2 really is, though Coinbase announced a SOC 2 Type 1 audit for staking services in July 2025.

Security features include biometric login, two-factor authentication, withdrawal address whitelisting, and anti-phishing protections. Coinbase has kept a relatively clean track record with few major security incidents.

Binance Security

Binance runs the Secure Asset Fund for Users (SAFU), an emergency insurance fund built from trading fees to protect users during worst-case scenarios. The fund has been tapped before to reimburse users after security problems.

Most user funds sit in cold storage, similar to Coinbase. Binance offers device management, two-factor authentication, withdrawal whitelists, anti-phishing codes, and security alerts.

In 2019, Binance got hit hard. Attackers stole 7,000 Bitcoin worth about $40 million at the time. The exchange covered the full loss through SAFU without touching user balances. No major breaches have been reported since.

Binance's security disclosure is murkier than Coinbase's. The platform doesn't publish detailed audit information or comprehensive security reports.

Regulatory Compliance and Trust

Coinbase wins on regulatory compliance, especially in the U.S., where it's fully licensed across all 50 states. This framework provides more transparency and accountability.

Binance's regulatory picture is messier. It holds licenses in over 20 countries and works toward compliance, but its global reach and past operational approach have attracted more regulatory scrutiny. The company operates under multi-year compliance monitoring after its 2023 settlement.

For U.S. users, Binance.US is a separate entity registered with FinCEN, but offers less transparency than Coinbase about security practices and insurance coverage.

Geographic Availability and Regulatory Considerations

Where you live determines which version of these platforms you can actually use. Some people get access to both Coinbase and Binance global, giving them the full range of options. Others are stuck with restricted versions or can't use one of these exchanges at all.

United States Users

Coinbase in the US

Coinbase operates with full licenses across nearly all 50 U.S. states. Direct bank account integration works smoothly, tax reporting comes built-in with 1099 forms, and you get access to every feature the platform offers without geographic restrictions.

The regulatory clarity here matters. Coinbase navigates U.S. compliance requirements successfully, which means fewer surprises about features disappearing or accounts getting restricted.

Binance for US Users

U.S. residents can't touch Binance Global. Instead, there's Binance.US—a separate company operating under different management with a fraction of the features.

Binance.US offers around 150 cryptocurrencies compared to global Binance's 500+. No futures trading, no margin, no leveraged tokens. The fee structure is competitive (0% maker, 0.01% taker), but you're missing most of what makes Binance attractive to experienced traders.

The platform resumed USD services in February 2025, allowing eligible customers to deposit and withdraw via bank transfers (ACH) in most supported states. But it's still unavailable in 14 states, including New York, Texas, Hawaii, and Vermont, among others.

If you're American and serious about crypto, you should check whether Binance.US even operates in your state before considering it.

International Availability

Coinbase International

Coinbase operates in over 100 countries with strong regulatory compliance and local currency support in major markets, especially across Europe. The platform maintains VASP approval in the UK and regulatory clearance throughout the EU.

Feature availability can vary by region, but Coinbase aims for consistency. What you get in the U.S. is mostly what you get elsewhere, minus any country-specific regulatory restrictions.

Binance Global

Binance serves over 275 million users globally and operates in far more countries than Coinbase. Outside restricted regions, you get the full platform: 500+ cryptocurrencies, futures, margin, DeFi integrations, everything.

But Binance has also been forced out of multiple markets. Regulatory pressure keeps pushing Binance to exit certain jurisdictions or to limit operations.

The platform holds licenses in over 20 countries, including Japan, France, and the UAE. It's working toward compliance in multiple regions, but the regulatory landscape keeps shifting.

Regulatory Risks

Laws change, enforcement actions happen, and platforms adjust quickly, sometimes overnight.

Binance faces ongoing compliance monitoring following its 2023 settlement. The company is rebuilding trust with regulators, but that process takes time and doesn't guarantee smooth sailing everywhere.

Coinbase has clearer regulatory standing, but regulatory risk never disappears completely in crypto.

Before committing to either platform, check:

Is the exchange available in your location?

What features are restricted in your region?

Has the exchange faced regulatory action in your country recently?

Do you have a backup plan if your primary exchange exits your market?

Many experienced crypto users maintain accounts on multiple exchanges for exactly this reason. Regulatory changes can lock you out faster than you expect.

Customer Support and Educational Resources

When something goes wrong with your account, and eventually something will, the quality of customer support matters. Same goes for learning resources crypto is complicated; having decent educational materials can save you from silly mistakes.

Customer Support Quality

Coinbase Support

Coinbase offers phone support for urgent issues, which already puts it ahead of most crypto exchanges. Response times vary based on issue complexity, but users generally report better experiences than with other exchanges.

If your account gets locked or a withdrawal gets stuck, you'll likely hear back within 24-48 hours.

What you get:

Phone support for urgent account issues

Comprehensive help center and FAQ

Email support with relatively quick response times

Community forums and social media support

Generally higher customer satisfaction ratings

The phone support option is huge for people who aren't comfortable troubleshooting technical issues through email. Being able to talk to someone when money is stuck makes a difference.

Binance Support

Binance relies primarily on chat and email support - no phone option. The platform offers 24/7 availability and supports multiple languages, which helps its global user base.

Wait times can stretch longer than Coinbase, especially during high-traffic periods when everyone's trying to contact support at once.

Support channels include:

24/7 chat and email support

Comprehensive knowledge base

Community forums (user-driven)

Multi-language support

Security and account recovery assistance

The knowledge base is comprehensive if you're willing to dig through it yourself, but you're often relying on other users in forums rather than official representatives.

Binance.US Support

Binance.US support is noticeably weaker than both Coinbase and global Binance. Limited availability, slower response times, and fewer support channels make it frustrating when issues pop up.

Educational Resources

Coinbase Learn

Coinbase Learn integrates educational content directly into the platform with video tutorials, interactive lessons, and straightforward explainers. The content covers crypto basics without assuming prior knowledge, making it accessible for complete beginners.

Key features:

"Earn while you learn" program (get paid small amounts of crypto for completing courses)

Beginner-friendly video tutorials

Interactive lessons built into the platform

Clear explanations without overwhelming jargon

Content stays beginner-friendly, which is great if you're starting out but limiting if you want advanced trading strategies or deep technical analysis.

Binance Academy

Binance Academy offers a massive library covering everything from blockchain fundamentals to advanced trading concepts. The depth here surpasses Coinbase Learn by a wide margin.

What's covered:

Basic blockchain and crypto concepts

Advanced trading strategies and technical analysis

Market research and analysis reports

DeFi protocols and new crypto trends

Risk management and portfolio strategies

The trade-off? Beginners might find Binance Academy overwhelming compared to Coinbase's more accessible approach, but traders who want more than the basics will find useful material here.

Advanced Features and Tools

Moving beyond basic buying and selling, both platforms have features for more experienced traders. The gap here gets wide. Coinbase keeps things relatively simple, while Binance throws in everything but the kitchen sink.

Trading Features Comparison

Coinbase Advanced Features

Coinbase Advanced Trade replaced Coinbase Pro and gives you professional-grade tools without leaving the main platform. You get real-time order books, advanced charting, multiple order types (limit, stop, market), and portfolio tracking tools.

Available features:

Advanced charting with technical indicators

Limit orders, stop-loss orders, and market orders

Recurring buy options for dollar-cost averaging

Portfolio insights and performance tracking

API access for institutional users and developers

Limited futures trading (not available in all regions)

The futures and derivatives offerings are minimal compared to Binance. Coinbase keeps things focused on spot trading and staking, avoiding the more complex (and risky) leveraged products that can blow up accounts quickly.

Binance Advanced Features

Binance built its reputation on offering every trading product imaginable. Spot trading is just the beginning.

What's available on Binance Global:

Spot, margin, and futures trading with up to 125x leverage

Options and derivatives markets

Copy trading (follow successful traders automatically)

Extensive API for algorithmic and bot trading

Grid trading and other automated strategies

Binance Smart Chain integration for DeFi

NFT marketplace

Token launchpad for early access to new projects

Binance.US gets a stripped-down version - spot trading, basic staking, and limited order types. No futures, no margin, no leveraged tokens. It's closer to Coinbase's feature set but with lower fees.

Wallets: Exchange vs Self-Custody

When you buy crypto on either platform, it sits in an exchange wallet controlled by the company. You can trade easily, but you don't hold the private keys. If the exchange crashes or gets hacked, your funds could disappear.

Self-custody wallets flip this around. You control the private keys, only you can access the funds. Lose those keys though, and your crypto is gone forever.

Coinbase Wallet

Image via Coinbase

Coinbase Wallet runs as a separate app from the exchange. You control the keys, not Coinbase. It supports thousands of tokens across different blockchains and gives you direct access to DeFi. You can also store NFTs and use the built-in dApp browser.

The integration with Coinbase exchange makes transfers smooth. Buy on the exchange, move to the wallet when you want full control.

Binance Wallet Options

Image via Binance

Binance uses Trust Wallet (which it owns) as its main self-custody option. Trust Wallet supports over 60 blockchains, lets you stake directly from the wallet, and includes a dApp browser for DeFi access.

Binance also built Web3 Wallet into the exchange itself. You can interact with DeFi without leaving the exchange or downloading another app.

Additional Services

Coinbase Ecosystem

Coinbase built out several services beyond the main exchange:

Coinbase Card: Debit card that lets you spend crypto at regular stores

Coinbase Prime: Institutional platform with advanced custody and trading tools

Developer platform: APIs and tools for building crypto payment systems

The ecosystem stays tight and focused. Everything connects cleanly, but there's less variety than Binance offers.

Binance Ecosystem

Binance went the opposite direction, building out a massive interconnected crypto empire:

Binance Smart Chain: Its own blockchain competing with Ethereum

Binance Card: Crypto debit card for spending

Launchpad: Early access to new token launches before they hit other exchanges

Binance Labs: Investment arm funding crypto projects

NFT marketplace: Buy and sell NFTs without leaving the platform

Extensive DeFi integrations: Yield farming, liquidity pools, lending

The Binance ecosystem sprawls everywhere. You can do almost anything crypto-related without leaving the platform, but figuring it all out takes time.

Pros and Cons

Coinbase | Binance (Global) | |

✓Pros | • Beginner-friendly and easy to navigate • Highly regulated (NASDAQ-listed, U.S.-based) • Strong customer support and insurance coverage • Secure cold storage and FDIC protection • Integrated tools like Coinbase Wallet and Base network | • Lowest trading fees (0.1% or less with BNB) • 500+ coins and high liquidity • Advanced tools (futures, margin, copy trading) • Deep ecosystem: BNB Chain, DeFi, NFTs, Launchpad • Strong mobile and API trading features |

✗Cons | • Higher fees (up to 0.45% per trade) • Limited coin selection • Occasional slowdowns during market spikes • Few advanced trading features | • Complex for beginners • Ongoing compliance oversight through 2028 • Unavailable in some countries • Support delays under high load |

Coinbase trades higher fees for simplicity and regulatory clarity. It's the safer choice for beginners.

With Binance, you get dramatically lower fees and far more cryptocurrencies. You’ll have to get to grips with a more complex exchange, but that can be fun for some.

Binance.US sits awkwardly in the middle - lower fees than Coinbase, but missing most of what makes global Binance attractive. Only worth considering if you're in a supported state and want cheaper fees without Coinbase's premium.

Making Your Choice: Binance vs Coinbase

The Coinbase vs Binance debate doesn't have a universal winner. Most experienced traders don't pick sides permanently. They use Coinbase for simplicity and security, then branch into Binance when they're ready for more advanced features and altcoin hunting.

While Binance and Coinbase might be the most well-known it’s not to say that there aren’t other exchanges worth your time exploring either.

New to crypto or want to level up your strategy? Learning Crypto uses AI-powered tools to personalize your crypto education, track your portfolio in real-time, and cut through market noise with expert insights

FAQ

Which is safer: Coinbase or Binance?

Coinbase has stronger regulatory oversight, especially in the U.S., with transparent security audits and insurance coverage. Binance has improved security substantially, but operates with less regulatory clarity.

Can I transfer crypto between Coinbase and Binance?

Yes. You can send crypto from one exchange to the other using wallet addresses. Make sure you're using the correct network and double-check addresses before sending. Network fees apply, and transfer times vary by blockchain.

Which exchange is better for beginners?

Coinbase wins for beginners. The interface is simpler, educational resources are more accessible, and customer support is better. The higher fees hurt less when you're starting with smaller amounts and still learning the basics.

How do I decide between Binance.US and Coinbase?

First, check if Binance.US operates in your state. If available, Binance.US offers lower fees but fewer cryptocurrencies and no advanced features like futures trading. Choose Coinbase if you want more coins and full U.S. regulatory compliance. Choose Binance.US if fees matter most and you're okay with a limited selection.

Do I need different tax reporting for each exchange?

Yes. Each exchange generates its own transaction history. Coinbase provides 1099 forms for U.S. users automatically. Binance.US and Binance Global require you to export transaction data manually.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.