Pump and Dump Schemes in Crypto: How to Spot and Avoid Them

You've probably seen it happen: a cryptocurrency with a name like "SafeMoonRocket" or a token named after an obscure animal (AxolotlCoin, anyone?) suddenly explodes 800% overnight.

Social media floods with screenshots of massive gains, Telegram groups buzz with thousands of euphoric investors, and FOMO starts clawing at your rational brain.

Maybe you've even thrown money at one of these "opportunities," only to watch your investment evaporate faster than morning dew in Death Valley.

These aren't random market events; they're carefully orchestrated pump and dump schemes, with a single aim to fill their bags while bleeding retail investors dry.

While the technology behind blockchain represents genuine innovation, the wild-west nature of cryptocurrency markets has created a perfect hunting ground for modern-day snake oil salesmen.

The mechanics are simple, the execution is ruthless. If you're wondering how to spot these traps before they spring shut on your wallet, you're asking the right questions.

What You’ll Learn in this Guide

How a pump and dump scheme works - How organized groups coordinate to separate you from your crypto

Why tech-savvy investors still fall victim - The psychological warfare that makes smart people do dumb things

Red flags that scream "run away" - Spotting coordinated hype, vaporware projects, and liquidity traps before you get burned

The technology powering modern scams - Bot networks, dark web coordination, and blockchain evasion techniques that make these schemes nearly invisible

A bulletproof defense strategy - Practical systems that protect your portfolio when FOMO starts clouding your judgment

What Are Pump and Dump Schemes?

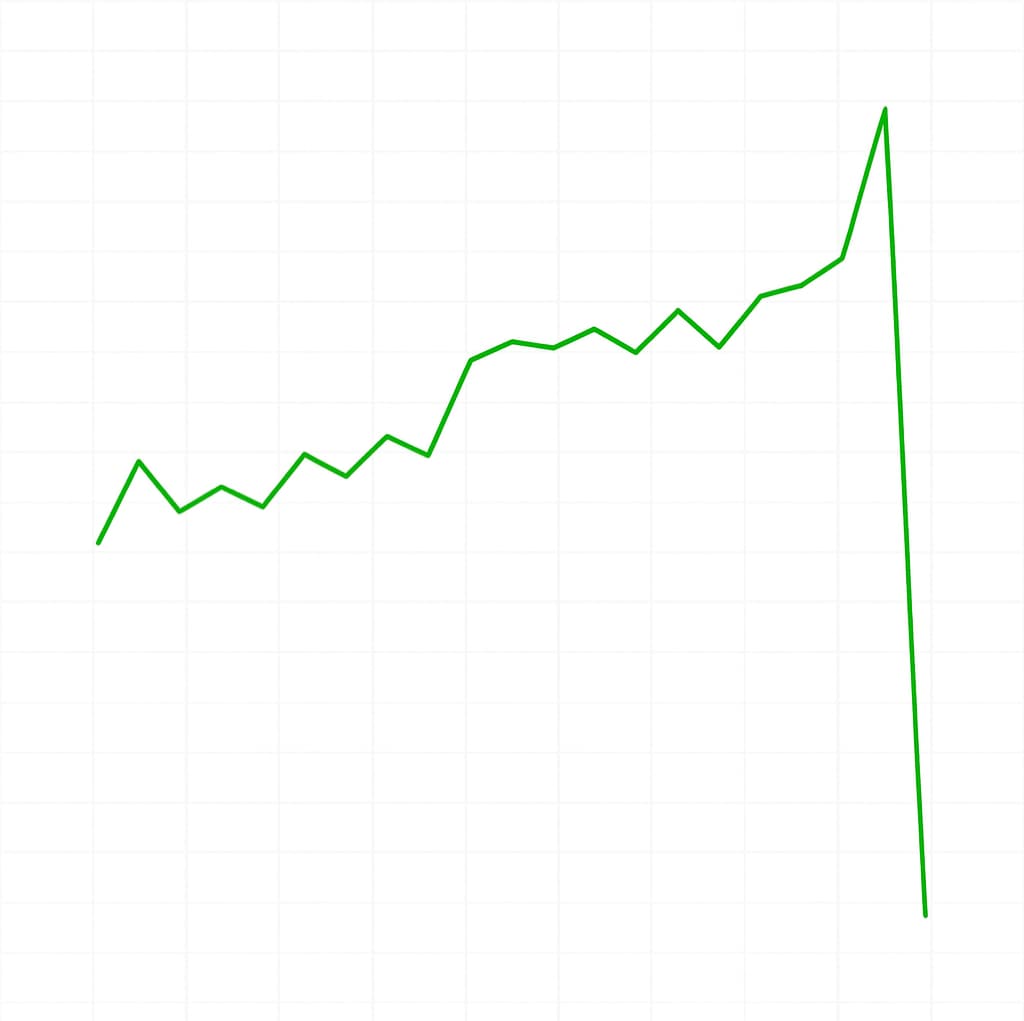

A pump and dump scheme is a form of market manipulation where the price of an asset is artificially inflated (the “pump”) through misleading statements and promotional activities, followed by a rapid sale of the asset by the perpetrators (the “dump”) at the inflated price.

This leads to a sharp decline in the asset’s value, causing substantial losses for those who bought in during the inflated period.

Pump-and-dump schemes aren't some crypto-age invention; they're as old as markets themselves.

In the 1920s, stock promoters spread rumors through newspapers and word-of-mouth to drive up penny stock prices before cashing out. The infamous "boiler room" operations of the 1980s and 90s saw aggressive telemarketers cold-call investors to push worthless stocks with promises of guaranteed returns.

What's changed isn't the basic psychology; greed, FOMO, and the dream of easy money remain wonderfully consistent human traits. What's evolved is the delivery mechanism.

Where once you needed expensive phone banks and newspaper ads, today's scammers wield the viral power of social media, AI bots, and 24/7 markets.

Inside the Scammer's Playbook: How Pump and Dump Schemes Work

The Modern Pump and Dump Operation

The blueprint is disturbingly straightforward and depressingly effective. Organized groups quietly accumulate massive positions in low-value, obscure tokens, often coins trading for fractions of a penny with the liquidity of a desert oasis.

These aren't random dartboard selections; they're carefully chosen for maximum manipulation potential.

Once positioned, the real theater begins. Coordinated marketing campaigns flood every corner of the internet, creating artificial excitement that would make a Disney marketing team jealous.

Social media influencers, many secretly collecting paychecks they'll never disclose, begin promoting the token with the kind of manufactured enthusiasm usually reserved for energy drinks or workout supplements.

Their followers have no clue these "hot tips" are actually paid advertisements wearing a disguise thinner than a politician's campaign promises.

The snowball effect kicks in as retail investors pile in during the artificial price surge. FOMO drives buying frenzies that push prices higher while the original conspirators quietly prepare their exit strategy.

At peak prices, when euphoria reaches fever pitch and everyone's calculating their Lamborghini payments, the scammers dump their massive holdings onto the unsuspecting crowd below.

The Three-Phase Attack Pattern

Every pump and dump follows the same predictable pattern:

Set up Phase: Scammers methodically purchase large positions in their chosen tokens while prices remain low and public attention is minimal. This stage can last weeks or months as they quietly build positions worth millions.

Pump Phase: The marketing machine activates across every platform imaginable. Coordinated posts, influencer endorsements, fake news articles, and bot armies create an illusion of organic excitement and a legitimate investment opportunity.

Dump Phase: At predetermined price targets, the conspirators execute their exit strategy with military precision. They systematically unload their massive holdings onto the market, flooding it with supply just as retail euphoria peaks.

The sudden avalanche of selling pressure sends prices into free fall, triggering panic among legitimate investors who scramble to salvage whatever they can.

By the time the dust settles, the original promoters have vanished with their profits, leaving everyone else clutching bags full of digital dust.

Why Crypto Markets Are Perfect for These Schemes

The crypto market didn't intentionally create ideal conditions for manipulation, but here we are anyway. Thousands of low-liquidity tokens sit around like unlocked cars in a bad neighborhood, while regulators try to apply 20th-century solutions to 21st-century problems with predictably messy results.

Global participation through anonymous wallets makes organizing these schemes simpler than planning a surprise party.

Meanwhile, social media algorithms actively amplify get-rich-quick content because engagement-driven platforms profit from the same volatility these schemes create. It's almost poetic, in a darkly ironic way.

The crypto community's deep-rooted FOMO culture provides the final ingredient - a steady stream of eager participants ready to chase whatever's mooning this week.

When your investment strategy revolves around diamond hands and rocket ship emojis, critical thinking tends to take a backseat.

The Technology Behind Modern Crypto Pump and Dumps

Understanding the basic psychology and mechanics of pump and dump schemes is just the beginning.

Today's scammers operate with the technological sophistication of a Silicon Valley startup, leveraging automation, blockchain complexity, and digital coordination tools that would make legitimate businesses envious.

Bot Networks and Artificial Engagement

Modern scammers deploy thousands of AI-powered social media bots that mimic real users with convincing profiles and posting histories.

These bots create artificial trading volume, flood comment sections with hype, and generate fake follower growth that tricks both algorithms and humans. When you see a token "going viral" overnight, you're probably watching a bot network in action.

Dark Web Coordination and Planning

Behind the public spectacle lies a shadow infrastructure of private coordination channels.

These aren't casual Telegram groups; they're sophisticated command-and-control networks operating across encrypted platforms, often on the dark web, where traditional law enforcement struggles to monitor activity.

Blockchain Analysis Evasion Techniques

Instead of holding massive positions in single wallets, they distribute holdings across hundreds or thousands of wallet addresses, making their true position size nearly impossible to detect without extensive analysis.

Mixing services and privacy coins help launder the source of funds, breaking the blockchain trail that investigators might follow.

Even their timing strategies are carefully planned to avoid creating obvious manipulation patterns that automated monitoring systems might flag.

The result is a cat-and-mouse game where enforcement agencies are always playing catch-up to increasingly sophisticated evasion techniques.

How to Spot a Pump and Dump Before It’s Too Late

Pump and dumps leave footprints. The trick is learning to recognize them before you’re the one holding the smoking crater of a portfolio.

The Coordinated Chorus Effect

The first clue usually comes in the form of suspiciously synchronized hype. You’ll see Telegram groups, Twitter threads, and TikTok videos all suddenly buzzing about the same obscure token. It’s like when a new fast-food menu item drops and somehow everyone you know is talking about it—but in this case, the “secret sauce” is pure manipulation.

The Vaporware Special

Next, watch for the mystery moonshot coin with no real reason to exist. If the project’s website looks like it was put together in an afternoon, the whitepaper reads like a high-school essay, and the development team is more anonymous than a witness in a mob trial, you’ve found your first red flag.

Legitimate projects can be small and scrappy, but if the “About Us” page only lists first names and a cartoon avatar with laser eyes, proceed with caution.

Influencers Gone Wild

Another tell: influencers suddenly turning into evangelists. If your favorite crypto YouTuber or Twitter “alpha” account is hyping a token like it’s the second coming of Ethereum, chances are good they’re either being paid under the table or they got in early and are now prepping their exit. Remember, nobody tweets 17 times a day about a coin out of pure altruism.

The Liquidity Trap

Then there’s the liquidity trap. Pumpers love illiquid tokens because they can swing prices with relatively small amounts of money. If you see a token with thin trading volume - where a single big buy moves the price like a jet ski turning in a kiddie pool - that’s prime pump-and-dump territory.

Too Good to Be True Promises

Finally, beware of unrealistic promises and instant riches. If a coin’s main selling point is “going to the moon” without offering any actual technology, partnerships, or roadmap, that’s not an investment - that’s a carnival ride. And like all carnival rides, it ends with someone puking (usually your portfolio).

Spotting these signs doesn’t mean you’ll never be tempted. FOMO is a powerful drug, but it does give you the chance to step back, breathe, and ask some important questions.

The Psychological Warfare: Why Smart People Fall for These Schemes

Link Alt text: a stressed trader sits at a desk with multiple monitors displaying falling crypto charts.

Crypto enthusiasts aren't your typical investment suckers. They're tech-savvy individuals who've figured out how to manage private keys without losing their life savings to a misplaced sticky note.

They understand blockchain technology well enough to explain smart contracts at dinner parties.

They're early adopters with the curiosity and risk tolerance to explore emerging technologies that most people still consider digital voodoo.

These are responsible, intelligent people who've done their homework on decentralization, researched DeFi protocols, and probably know more about cryptographic security than their own bank managers.

They're the kind of investors who read whitepapers for fun and can spot a rug pull from a mile away, or so they think.

But even these positive traits don't always protect them from pump-and-dump schemes. In fact, sometimes, these very characteristics make them perfect targets.

Their comfort with technology can breed overconfidence. Their early adopter mentality makes them eager to jump on the "next big thing." Their deep knowledge of crypto can create blind spots where they assume they're immune to manipulation.

Pump and dump schemes don't prey on ignorance; they exploit psychology. And psychology doesn't care how many GitHub repositories you've starred or how perfectly you can explain the Byzantine Generals Problem.

The FOMO Factory

Scammers understand that fear of missing out isn't rational; it's primal. They manufacture urgency through artificial scarcity and time pressure. "Only 48 hours left before the private sale ends!" or "Last chance to get in before the big exchange listing!" Psychological pressure valves designed to short-circuit your decision-making process.

The most insidious part? They use your own community against you. Those Telegram groups and Discord channels filled with "diamond hands" and rocket ship emojis aren't organic enthusiasm but carefully orchestrated echo chambers.

When you see hundreds of people celebrating their "gains" and sharing screenshots of green portfolios, your brain interprets this as social proof that you're missing out on something real.

The Sunk Cost Trap

Once you're in, the psychological warfare intensifies. As prices start dropping, the "diamond hands" narrative kicks into overdrive. "HODL!" becomes a battle cry, "paper hands" becomes an insult, and selling at a loss feels like admitting defeat to an entire community watching your every move.

This is weaponized psychology. The crypto culture's emphasis on holding through volatility, originally a sensible long-term investment strategy, gets twisted into a trap that keeps victims invested even as their portfolios hemorrhage value.

Confirmation Bias in Echo Chambers

Those same Telegram groups that initially sold you on the investment become information filters that reinforce your decision. Positive news gets amplified and celebrated, while negative information gets dismissed as "FUD" spread by competitors or bitter investors who "missed out."

Moderators, who are often part of the scheme, carefully curate these spaces, banning users who ask uncomfortable questions or share contradictory information. The result is a feedback loop where only bullish sentiment survives, creating an artificial consensus that feels like validation but is actually manipulation.

The Lottery Ticket Mentality

Perhaps most dangerously, pump-and-dump schemes exploit the crypto community's dream of life-changing wealth. The space is filled with stories of early Bitcoin holders becoming millionaires, creating a narrative that astronomical returns are not just possible but inevitable if you find the right project.

This lottery ticket mentality makes even rational investors susceptible to projects promising 1000x returns. When you're convinced that missing "the next Dogecoin" could cost you financial freedom, due diligence starts feeling like a luxury you can't afford. The fear of being left behind overwhelms the fear of losing money you've already invested.

Protecting Yourself Against Pump and Dumps

Now that you understand the psychology behind pump-and-dump schemes, let's reverse-engineer that manipulation to protect yourself.

You were probably nodding your head along when we discussed FOMO and confirmation bias, thinking, "Yeah, I can see how people fall for that, but I'm smarter than the average crypto investor."

But recognizing these tactics intellectually and actually resisting them in real-time are two completely different skills.

When you're staring at a coin that's up 400% and your Twitter feed is exploding with success stories, all that knowledge about psychological manipulation tends to evaporate fast.

You don't need superhuman willpower or the emotional detachment of a Buddhist monk. You just need systems.

Don't rely on making perfect decisions under pressure, but create frameworks that make those decisions for you before the pressure hits.

Here are some practical tips that work when your brain is screaming, "Buy now or regret it forever."

🔒 Top 10 Defense Tips Against Pump and Dumps

|

What to Do If You Get Scammed

So, let’s say the worst happened, and you FOMO’d into a token that tanked faster than a lead balloon. Now, you realize you were the mark in someone else’s playbook. Painful? Absolutely. The end of your crypto journey? Not at all.

Don’t chase losses. The instinct to “make it back” by doubling down on the next shiny coin is exactly what scammers hope for. It’s how they keep recycling victims. Accept the loss as tuition in the school of hard crypto knocks.

Secure what’s left. If you suspect you’ve interacted with a malicious smart contract, revoke token approvals and move your remaining funds to a safe wallet. Don’t leave crumbs behind for scammers to sweep up later.

Report it. While crypto is infamous for its lack of consumer protections, agencies like the FTC, SEC, or your local financial watchdog do track scams. At a minimum, reporting helps build cases against repeat offenders. Some exchanges also maintain scam-reporting portals.

Learn and adapt. Painful though it is, a loss can sharpen your instincts. Most seasoned investors have at least one war story about being burned—it’s how they developed the radar you’re building now.

Regulation and the Fight Against Scams

Crypto was built on ideals of decentralization and freedom, but that freedom has also created a playground for bad actors. Predictably, regulators have been scrambling to catch up.

The SEC and CFTC in the U.S. have brought high-profile cases against fraudulent token launches and influencer promotions, while the EU’s Markets in Crypto-Assets (MiCA) framework is rolling out stricter requirements for listings and marketing. Asia is a mixed bag. Singapore enforces tough licensing, while other regions are still the wild west.

But regulation alone can’t save retail investors. Even in tightly controlled markets, scams slip through the cracks because they evolve faster than laws do. By the time one loophole closes, scammers have already pivoted to the next.

That said, regulatory action does matter. Successful prosecutions create deterrence, exchanges are increasingly pressured to delist shady projects, and influencer disclosure rules mean fewer hidden pay-for-shill deals. It’s far from perfect, but it’s better than nothing.

Your best regulator is yourself. Learn the red flags, recognize the patterns, and don’t rely on governments to keep every wolf out of the flock.

Famous Crypto Scams You Should Know

Sometimes the best way to recognize a scam is to study the legends. Crypto’s short history is littered with spectacular cons:

BitConnect (2016–2018) – the king of Ponzi tokens, promising insane returns until it collapsed, wiping out billions. Its cheesy YouTube promo videos are now meme history.

OneCoin (2014–2017) – marketed as the “Bitcoin killer,” it raised $4 billion globally before being exposed as pure vaporware. Its founder, Ruja Ignatova, is still on the FBI’s Most Wanted list.

SafeMoon (2021) – hyped relentlessly on social media with celebrity endorsements. Its bizarre tokenomics and shady team behavior led to a dramatic collapse.

These cases differ in detail but are identical in pattern. Big promises, aggressive marketing, and an inevitable crash left retail licking its wounds. Study them, and the next too-good-to-be-true scheme might stand out like a neon sign.

Stay Safe Out There + Keep Learning

The crypto space rewards the prepared and punishes the reckless. You now have the tools to recognize the red flags, understand the psychology, and protect your portfolio from sophisticated manipulation schemes. Use them.

Protecting yourself from pump and dumps is just the beginning. LearningCrypto offers comprehensive tools to sharpen your crypto skills:

Market Analytics - Real-time data, on-chain metrics, and whale tracking to spot market movements before they happen

AI-Driven Education - Learn with AI assistants Tobo and Heido for personalized crypto education at your pace

Portfolio Tracking - Professional tools to monitor performance and manage risk across all your holdings

Knowledge isn't just power in crypto - it's profit protection.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.