What Is a Fork in Crypto? Hard Forks vs. Soft Forks Explained

TL;DR A cryptocurrency fork happens when a blockchain's protocol changes, creating a split in the network. Soft forks are backward-compatible upgrades where all nodes stay on the same chain. Hard forks are incompatible changes that split the blockchain into two separate networks, sometimes intentionally, sometimes as a coordinated upgrade.

Forks are one of those parts of crypto that sound dramatic, and sometimes they are. Other times, they’re just routine upgrades. But many major chains have gone through them. Bitcoin, Ethereum, and Litecoin all have forks baked into their history.

This guide breaks down what cryptocurrency forks actually are, why they happen, the difference between hard and soft forks, and what they mean for you if you're holding crypto when one occurs. By the end, you'll understand why Bitcoin Cash exists, what went down with Ethereum Classic, and whether you should care about fork announcements.

What You’ll Learn

Why blockchains split and what actually triggers a fork

Hard forks vs. soft forks (and why the difference matters for your wallet)

The real story behind Bitcoin Cash, Ethereum Classic, and other famous splits

Whether you actually get "free money" when a fork happens

How to claim forked coins without getting scammed or losing your crypto

Why Bitcoin Cash is worth billions while most forks die within weeks

What Is a Fork in Blockchain?

A fork is a change to a blockchain's protocol or rules. Blockchains operate on consensus rules that all nodes follow. So when those rules shift, the network effectively faces two paths:

Follow the new rules

Stick with the old ones

The term comes from software development. When programmers "fork" code, they create a new version that diverges from the original. Same principle here, except we're talking about an entire financial network, often spanning thousands of machines.

If every node agrees to upgrade, the chain simply continues under the new rules. If part of the network refuses or disagrees, the blockchain can split into two separate networks, both sharing the same history up to the fork point.

Why Forks Happen

Forks are usually triggered for three main reasons.

Technical Upgrades

Most forks are planned improvements. Developers want to add new features, improve security, fix bugs, or help the network scale better. These upgrades get proposed, discussed, tested, and eventually implemented. If the community agrees and coordinates well, the fork happens smoothly, and everyone moves to the new version together.

Ethereum's transition to proof-of-stake involved multiple hard forks over several years. Bitcoin's SegWit upgrade happened through a soft fork. These weren't controversial splits; they were coordinated improvements.

Community Disagreements

This is where things get messy. Sometimes a portion of the community fundamentally disagrees with the direction of a blockchain. Different groups have varying visions for what the network should be, how it should scale, which features matter most, and how governance should operate.

When compromise fails, a faction can fork off and create its own version. Bitcoin vs. Bitcoin Cash is the classic case.

Emergency Response

Rarely, forks happen in response to hacks, exploits, or critical vulnerabilities. The most famous example is Ethereum's response to the DAO hack in 2016. After $60 million worth of ETH got stolen, the community faced a choice: accept the theft as "code is law," or fork the blockchain to reverse the transaction and return the stolen funds.

They chose to fork. Most of the network followed the new chain (Ethereum), but a minority remained with the original chain, where the hack had occurred (Ethereum Classic). Both still exist today.

How Forks Work Technically

A fork starts with a software update. Nodes download new client software containing different rules. When these upgraded nodes encounter blocks built under the old rules or vice versa, they disagree on validity.

If the rules are incompatible, the blockchain splits:

Both networks share the same history until the fork block.

After that, they diverge and continue independently.

Exchanges, wallets, miners, validators, and users choose which chain to support.

Nodes enforce the rules. They decide which blocks are valid and which aren’t. To learn how enforcement works at the network level, refer to our Guide on What Nodes Do.

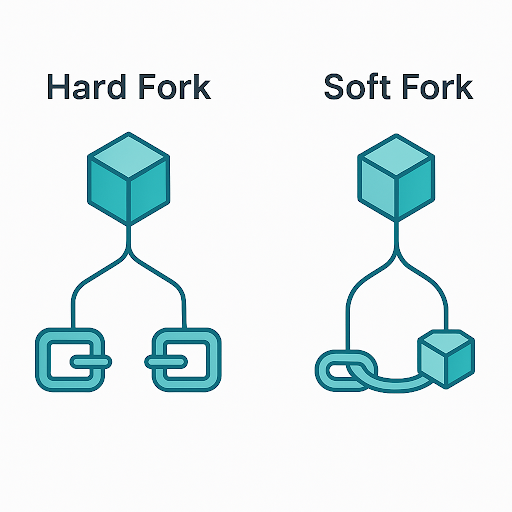

Hard Forks vs. Soft Forks

Hard Fork vs. Soft Fork Quick Comparison | ||

|---|---|---|

Aspect | Hard Fork | Soft Fork |

Compatibility | Non-backward-compatible | Backward-compatible |

Node Upgrade | All nodes must upgrade | Only majority needed |

Chain Split | Can create permanent split | No permanent split |

Disruption Level | High | Low |

Rule Changes | Can expand rules | Only narrows or restricts |

New Coin Creation | Possible | No |

Examples | Bitcoin Cash, Ethereum Classic | SegWit (Bitcoin) |

What Is a Hard Fork?

A hard fork is a non-backward-compatible change to the protocol. After a hard fork, nodes running the old software will reject blocks created by nodes running the new software. The two versions can't work together.

This creates a permanent divergence unless everyone upgrades. If some nodes upgrade and others don't, you get two separate blockchains. Holders of the original cryptocurrency typically receive equivalent coins on both chains.

Hard forks can expand the rules or make fundamental changes that old software simply can't process. Want to increase block size? Change the mining algorithm? Add entirely new transaction types? You need a hard fork.

When Hard Forks Are Used:

Major protocol overhauls

Adding significant new features

Contentious splits creating new cryptocurrencies

Emergency interventions (rare)

What Is a Soft Fork?

A soft fork is a backward-compatible change. Nodes running old software still accept blocks created by nodes running new software. The network stays unified.

Soft forks work by tightening rules, not expanding them. Old nodes might not understand new features, but they still recognize blocks as valid. Over time, as more nodes upgrade, the new features become standard.

Bitcoin's SegWit is a perfect example. It added new transaction types and features, but it did so in a way that old nodes could still process blocks, even if they didn't fully understand the new transaction format.

When Soft Forks Are Used:

Minor protocol improvements

Tightening security rules

Gradual feature rollouts

Less controversial changes

Famous Cryptocurrency Fork Examples

Bitcoin and Bitcoin Cash (2017)

This is the fork everyone hears about first.

The Issue

Bitcoin's 1MB block size limit was causing transaction backlogs and skyrocketing fees. By 2017, the debate over how to scale Bitcoin had reached a boiling point. One camp wanted bigger blocks to handle more transactions directly on-chain. Another camp preferred keeping blocks small and building scaling solutions like the Lightning Network on top of Bitcoin.

Years of heated debate led nowhere. The disagreement wasn't just technical - it was philosophical.

What should Bitcoin prioritize?

Being digital cash for everyday transactions? Or being a secure store of value?

The Fork

In August 2017, Bitcoin Cash hard forked from Bitcoin with 8MB blocks (eight times larger than Bitcoin's limit). Anyone holding Bitcoin received an equal amount of Bitcoin Cash. Two separate networks emerged: BTC and BCH.

Both sides claimed to represent Satoshi Nakamoto's original vision. Bitcoin Cash supporters said they were preserving Bitcoin as peer-to-peer electronic cash. Bitcoin supporters said they were maintaining decentralization by keeping full node requirements manageable.

The Outcome

Bitcoin (BTC) remained dominant by a massive margin. Bitcoin Cash (BCH) exists and has value, but it's worth a fraction of Bitcoin's price. The market voted clearly for Bitcoin's approach.

Bitcoin Cash itself later forked again in 2018, resulting in the creation of Bitcoin SV. That fork was even more contentious, proving that forks can keep happening when communities can't agree.

Ethereum and Ethereum Classic (2016)

This fork wasn’t about scaling. It was about the philosophy of immutability.

The Issue

The DAO was a decentralized autonomous organization built on Ethereum. Essentially, a venture capital fund run by smart contracts. It raised over $150 million in ETH. Then someone exploited a vulnerability in the code and drained about $60 million worth.

The Ethereum community faced a philosophical crisis. The code was working exactly as written, yet the hacker just found a loophole and used it. Should they respect "code is law" and let the theft stand? Or should they intervene and return the stolen funds?

The Fork

In July 2016, Ethereum hard forked to reverse the hack. The majority of the network followed the new chain (Ethereum/ETH), which returned the stolen funds to their original owners. A minority continued the original chain (Ethereum Classic/ETC), where the hack remained part of the permanent history.

This wasn't a technical disagreement. It was an ideological split. Ethereum Classic supporters believed that immutability was sacred and that blockchains shouldn't be altered for any reason, even in the case of theft. Ethereum supporters took a more pragmatic view, and that’s that the community should protect itself from exploits.

The Outcome

Ethereum became the dominant chain by far. It's now the second-largest cryptocurrency. Ethereum Classic still exists as a smaller alternative, maintained by those who believe in absolute immutability.

The fork demonstrated that community consensus, not just technology, determines which chain survives.

Other Notable Forks

Bitcoin SegWit (2017 - Soft Fork)

SegWit upgraded Bitcoin without splitting the chain. It increased capacity by changing how transaction data gets stored, enabled the Lightning Network, and fixed transaction malleability. The upgrade happened smoothly because it was backward-compatible.

Ethereum London/Merge (2021-2022 - Hard Forks)

Ethereum's transition from proof-of-work to proof-of-stake involved multiple planned hard forks over about two years. The community coordinated the entire process, so there was no contentious split. Everyone moved to the new version together, and the old proof-of-work chain effectively ceased to exist (though a small group tried to keep it alive as EthereumPoW with minimal success).

Litecoin Forks

Multiple attempts have been made to fork Litecoin, including Litecoin Cash and others. Almost all failed to gain any meaningful traction or value. They proved that just forking a blockchain doesn't automatically create something valuable.

What Forks Mean for Cryptocurrency Holders

Do You Get Free Coins During a Fork?

During hard forks that create new chains, yes, you typically receive an equivalent amount of the new coin. If you held 1 BTC before the Bitcoin Cash fork, you ended up with 1 BTC and 1 BCH.

But there are conditions. You must hold your coins in a wallet where you control the private keys. If your coins are on an exchange, the exchange decides whether to support the forked coin and credit your account. Not all exchanges support every fork.

And most forked coins are worthless or nearly worthless. Bitcoin Cash is a rare exception, with a fork that has actually maintained its value. Most forks are opportunistic money grabs that disappear quickly.

How to Handle Forks Safely

Before a Fork

Move your coins to a wallet where you control the private keys. Research whether the fork is legitimate or a scam. Don't respond to messages offering "fork support. "Those are almost always phishing attempts. Wait for official announcements from your wallet provider or exchange about their fork support.

After a Fork

Let the situation settle for days or even weeks before acting. Use replay protection if it's available. This prevents transactions on one chain from being valid on the other. Be extremely cautious about which wallet software you use to claim forked coins. Only use official software from verified sources.

Many scam wallets masquerade as fork claiming tools, designed to steal your private keys when you enter them.

Red Flags

Any fork requiring you to enter private keys on a website is a scam. Urgent messages about "claiming" fork coins immediately are usually phishing. Unknown wallet software specifically for fork claiming should be treated with extreme suspicion.

Conclusion: Forks as Blockchain Governance

Blockchains don’t have CEOs. They don’t have central decision-makers. Forks are the closest thing to governance these networks have.

Sometimes forks are calm, planned upgrades that move a chain forward.

Sometimes they’re ideological battles that create entirely new ecosystems.

And sometimes they’re emergency resets after something breaks.

Hard forks show what happens when consensus fails. Soft forks show how rule changes can be introduced gently.

Forks can be messy, contentious, and don't always work, but it's also what makes crypto genuinely different from traditional finance. No single entity gets to decide. The community votes with the software they run.

Ready to graduate from beginner guides?

Join our community of members building real crypto expertise through in-depth AI-powered education, professional-grade portfolio tools, and real-time market analysis.

FAQs

What happens if I hold coins on an exchange during a fork?

The exchange decides whether to support the fork and credit you with new coins. You don't control the private keys when your coins are on an exchange, so you're dependent on their policy. For important forks where you definitely want both coins, transfer to a private wallet before the fork occurs.

Can forks steal my cryptocurrency?

Forks themselves don't steal funds, but scammers exploit fork confusion. Fake wallets claiming to help you "claim" fork coins may steal your private keys when you enter them. Phishing messages about fork support are common. Legitimate forks never require you to do anything risky. Only use official, verified wallet software, and never enter private keys on websites.

Why do some forks succeed and others fail?

Successful forks need multiple things working together: strong community support, active developers, exchange listings that provide liquidity, and most importantly, a compelling reason to exist.

Do I need to do anything when a soft fork happens?

Usually nothing at all. Soft forks are backward-compatible, so the network upgrades around you. Your wallet and transactions continue working normally. You might eventually want to upgrade your wallet software to access new features, but there's no urgency and no risk of losing coins if you don't upgrade immediately.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.