Coinbase vs Kraken: Key Differences for Crypto Traders

TL;DR: Coinbase wins for simplicity and US coverage (all 50 states). Kraken wins for fees at half the cost, better customer support and more cryptocurrencies. But Kraken isn't available in some states, making location the deciding factor for many US traders.

When you're staring at dozens of crypto exchanges, the wisest move is to shortlist a few big players and decide from there. Today, we're breaking down Coinbase versus Kraken, two of the oldest, most trusted platforms in crypto.

Both are legitimate and secure, but each has unique features, pros, cons, and quirks that make them better suited for different people. Read on to figure out which one fits you.

What You'll Learn in This Comparison

How fees really compare from hidden spreads to maker/taker rates on both platforms.

Which exchange saves you money if you trade daily, stake, or just buy-and-hold.

Coin and staking options — see who lists more tokens and offers better yields.

Security breakdown — how both exchanges protect your funds (and what they don’t cover).

Where each platform is available — including which U.S. states Kraken still can’t operate in.

User experience showdown — apps, verification, and support quality compared side by side.

Advanced features for traders — margin, futures, APIs, and tools for serious investors.

When it makes sense to use both — many traders combine them for better results.

Coinbase vs Kraken at a Glance | ||

|---|---|---|

Feature | Coinbase | Kraken |

Founded | 2012 | 2011 |

Headquarters | United States | United States |

Regulation | Licensed in 50 US states, UK VASP, EU | Not available in NY, ME; global licenses |

Coin Selection | Strong coverage, curated list | Very broad, many smaller tokens |

Fees (spot trading) | Higher for small trades; improved with Advanced | Lower across most tiers |

Staking / Yield | ~20+ assets, integrated via UI | 28+ assets, relaunch in U.S. as of 2025 |

Security & transparency | Cold storage, insurance on hot wallets; public company | Strong cold storage, proof-of-reserves audits, no major hacks |

The Big Picture: Who Are These Platforms?

Coinbase at a Glance

Coinbase launched in 2012 to make crypto accessible to everyone. Over the years, it’s become one of the most recognized names in this space.

In 2025, it joined the S&P 500, a symbolic milestone showing how mainstream it’s become.

It operates in 100+ countries, reaches all U.S. states, and continues to push global expansion.

Coinbase leans toward compliance and simplicity, making trade-offs (like higher fees or fewer exotic tokens) in favor of ease, security, and regulatory certainty.

Read our Ultimate Guide to Coinbase

Kraken at a Glance

Kraken is one of the older crypto exchanges (founded circa 2011). It’s known for reliability, security, and serious trading infrastructure.

As of 2025, Kraken posted $472M revenue in Q1 with an adjusted EBITDA of $187M, which shows it’s a heavyweight in the industry.

It serves 190+ countries and recently climbed to #2 globally in Kaiko’s Q2 exchange rankings. Kraken often positions itself as the “exchange the pros use,” with powerful tools and deep markets.

In short:

Coinbase = polished, regulated, user-focused.

Kraken = powerful, broad, trader-friendly.

User Experience and Interface Design

Coinbase and Kraken take different approaches to interface design.

Coinbase Interface

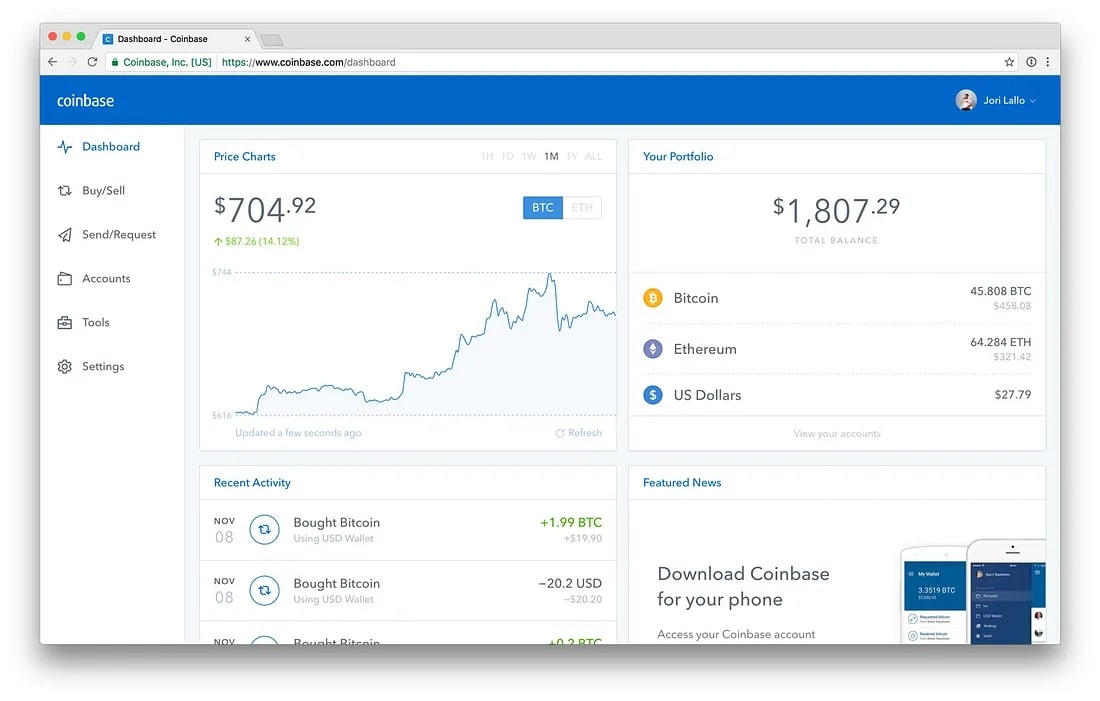

Image via Coinbase

Opening Coinbase feels like opening a well-designed stock trading app. Clean layout, minimal jargon, obvious next steps.

The standard interface shows your portfolio balance prominently, with big buy/sell buttons for each asset. Price charts are simple but clear. The flow from "I want Bitcoin" to "I own Bitcoin" takes about three taps.

For mobile users, Coinbase is hard to beat. The app handles everything smoothly - buying, selling, sending, receiving, viewing balances without overwhelming you with options. It's rated 4.6/5 on major app stores.

Coinbase Advanced Trade provides professional tools without professional confusion. You get TradingView charts, limit orders, stop losses, and portfolio tracking. It's not as simple as the basic interface, but it's cleaner than most competing professional platforms.

Kraken User Experience

Image via Kraken

Kraken assumes you know what you're doing. The interface shows order books, depth charts, multiple order types, and market data all at once.

Kraken Classic (the standard interface) packs information density over simplicity. You can see everything, but figuring out where "everything" is takes time. New users often report confusion during their first few trades.

Kraken Pro gives experienced traders even more control with customizable layouts, advanced charting, API access, multiple order types. It's powerful once you learn it, but the learning curve is real.

The mobile app (rated 4.4/5) is functional but less polished than Coinbase. It supports all major features, though some advanced tools work better on desktop.

Recent updates added smart widgets and theme customization, improving usability. Still, Kraken makes no apologies for catering to traders over casual buyers.

The Difference

If you want to own crypto without becoming a trader, Coinbase won't make you feel stupid. If you want maximum control and don't mind a steeper learning curve, Kraken gives you the tools.

Coinbase vs Kraken Fees

When comparing exchanges, fees are the biggest differentiator. Even small percentage differences can eat into your returns, especially if you trade often or with larger amounts.

Below is a breakdown of the fee types you’ll want to watch out for when comparing Coinbase and Kraken.

Fee Comparison | ||

|---|---|---|

Category | Coinbase | Kraken |

Spot Trading (Maker / Taker) | 0.60% / 0.60% → 0.05% / 0.14% (Advanced) | 0.16% / 0.26% → 0.00% / 0.10% (Pro) |

Simple Buy / Sell | Spread ~0.5% + small flat fee | Spread markup on Instant Buy |

Bank Deposit (ACH) | Free | Free |

Card Purchase | ~3.99% | Limited / Varies |

Wire Transfers | $10–25 (U.S.) | Low or fixed fee by region |

Crypto Withdrawal | Network fee | Fixed per asset (near network cost) |

Note: The specific percentages and fees depend on your region, verification tier, and volume. Always check the live fee schedule in your account.

Spot Trading Fee Structures

Coinbase Standard uses a simplified pricing model that combines multiple fees into one. You're paying around 1.49% for bank transfers and up to 3.99% for card purchases, plus a hidden spread fee of roughly 0.50% baked into the quoted price.

For a $1,000 BTC buy, that can cost you $20–$40 or more, depending on payment method.

Coinbase Advanced Trade switches to the industry-standard maker-taker model:

Taker fees: 0.60% (under $10K monthly volume), dropping to 0.40% above $10K

Maker fees: 0.40% (under $10K monthly volume)

Volume discounts kick in at higher tiers, though most retail traders won't hit them.

There's also Coinbase One at $29.99/month, which eliminates trading fees on purchases up to $10,000 per month. The math works if you're consistently trading near that limit.

Kraken keeps it straightforward with transparent maker-taker pricing:

Maker fees: Start at 0.16%

Taker fees: Start at 0.26%

Stablecoin trading: 0.20% fee

Instant Buy: 0.9% for stablecoins, 1.5% for other cryptocurrencies

These fees drop with volume. Cross $50,000 in 30-day trading, and you're at 0.14% maker / 0.24% taker. Push into seven figures monthly, and maker fees hit 0.00%.

Spread Fees and Hidden Costs

This is where Coinbase Standard gets expensive. The spread fee, the difference between buy and sell prices runs around 0.50% but can widen during volatile markets. It's not listed separately, just baked into the price you see.

Example: If Bitcoin trades at $50,000 on the open market, Coinbase Standard might show you a buy price of $50,250 and a sell price of $49,750. That $500 difference ($250 each direction) is the spread. A 0.50% fee you're paying without seeing it itemized.

Coinbase Advanced and Kraken don't use spread fees. You pay the listed maker/taker fee, period. What you see is what you get.

Deposit / Withdrawal Fees (Fiat & Crypto)

Fiat (Bank, Card, Wire)

Coinbase

Bank transfers (ACH in the U.S., local rails in other countries): often free

Debit/credit card purchases: ~3.99% (U.S.), plus whatever your region supports

Wire transfers: ~$10 incoming, $25 outgoing (in U.S. context)

Instant payouts (to debit card, etc.): small fees for fast access

Kraken

Supports free or low-cost bank/ACH/SEPA transfers in many regions

Wire transfers are supported; inbound often free, outbound incur fixed fees

Card purchases in Kraken app or via Apple Pay / Google Pay may be supported in some regions (with premium)

Crypto Withdrawal & Deposit

Both exchanges typically do not charge you for crypto deposits (you bear the blockchain network fee from sender).

For withdrawals:

Coinbase passes the network fee at the time of withdrawal. No additional hidden markup.

Kraken uses a fixed withdrawal fee per asset, usually designed to mirror near-network costs. Some smaller tokens or alternative networks (e.g., TRON, etc.) may have especially low withdrawal costs.

Verdict: When Each Platform Is Cheaper

For small trades or casual users

Coinbase’s convenience may dominate - although, because of flat fees and spreads, a $50 trade could cost you 2% or more. Kraken’s lower base fees still usually win if you use Pro, but the difference is less dramatic.

For medium-to-high volume trading

Kraken almost always wins. The lower maker/taker rates and minimal spread/hidden cost put it ahead. As volume climbs, Kraken’s tiered pricing amplifies savings.

For frequent withdrawals or fiat movements

Kraken tends to have lower or simpler withdrawal and deposit fees, especially in regions where it supports local banking rails. If you’re moving money often, Kraken’s edge grows.

In high network congestion periods

Either exchange’s crypto withdrawal could become pricey, but since Coinbase passes the real-time network fee, and Kraken charges fixed fees, you’ll need to compare at the moment. Sometimes Kraken’s fixed fee is less than the spiked network fee that Coinbase passes (or vice versa, depending on how aggressively Kraken’s fixed fee is set).

Bottom line:

Use Coinbase’s Advanced Trade mode, avoid simple/instant mode if you care about cost.

Use Kraken Pro for best fee outcome.

For frequent or volume trades, Kraken is a clear winner.

For convenience, flexibility, and instant moves, Coinbase is tougher to beat- but you pay extra.

What Crypto & Fiat Do They Support?

Let’s compare coin selection and listing philosophy.

Coinbase Asset Offerings

As of writing, Coinbase lists 300+ cryptocurrencies across 460+ trading pairs. The selection includes all the major players; Bitcoin and Ethereum, Solana, Cardano, Polkadot with a solid range of DeFi tokens, Layer 2’s and established altcoins. Some tokens are region-limited (in certain states or countries)

New listings go through Coinbase's compliance review process. Every coin gets vetted for regulatory issues before it hits the platform. This means slower additions but fewer scam tokens making it through.

In Q2 2025 alone, Coinbase added 21 new cryptocurrencies and planned for 50-80 more throughout the year. The pace is picking up, though it still lags behind platforms with looser listing criteria.

⚡Fun Fact: Recently, Coinbase was criticized for not giving $TRUMP token special treatment, having to pass through normal listing review processes just like any other coin.

Trading pairs lean heavily toward USD, EUR, GBP, and major crypto-to-crypto pairs like BTC and ETH.

Kraken Asset Selection

Kraken supports 450+ cryptocurrencies with over 700 trading pairs. The platform lists all major assets and a good selection of smaller/mid-cap altcoins.

The listing process is less restrictive than Coinbase's, meaning tokens show up faster but with marginally higher risk. Kraken updated its vetting in recent years to filter obvious scams, but the bar remains lower than Coinbase's compliance-first approach.

Kraken, in addition, offers something unusual: traditional forex and stock trading for US users (in eligible states). You can trade 11,000+ US stocks and ETFs commission-free directly through the platform, making it genuinely all-in-one.

The platform also runs Kraken Launchpad, giving early access to new token launches before they hit other exchanges. If you want to catch new projects early, this matters.

Staking and Earning Opportunities

Coinbase would have won this category hands down if Kraken hadn't relaunched staking for US users in January 2025.

For nearly two years, Coinbase was the only option between these two platforms for Americans wanting to earn yield on crypto. That changed when Kraken brought back its on-chain staking product.

Coinbase Staking

Coinbase makes staking dead simple. One-click enrollment with automatic reward compounding. Rewards vary; some assets earn low single digits while others reach double digits.

The platform handles all the technical complexity. You don't run validators or manage nodes. Just opt in, and rewards start flowing. Unstaking is straightforward too, though network unbonding periods still apply (these are blockchain requirements, not Coinbase rules).

Available in most US states, with some restrictions in Hawaii and New York for certain assets.

Kraken Staking

Kraken's staking relaunch brought back competition. The platform now offers bonded staking for 17 assets, including ETH, SOL, DOT, and ADA. Bonded staking means your assets lock to the network for specific periods. You're committing them for the duration.

The upside? Competitive yields that often match or beat what you'd find elsewhere. The downside? Geographic restrictions are tighter than Coinbase.

Available in 39 US states and territories. Staking specifically is NOT available if you live in California, Maryland, New Jersey, or Wisconsin. And if you're in New York or Maine, Kraken doesn't operate there at all - no trading, no staking, nothing.

Kraken includes third-party slashing insurance coverage, which protects against validator failures. That's something Coinbase doesn't explicitly offer. Rewards get paid out regularly, and the platform handles validator delegation automatically.

Security Measures and Track Records

Both platforms take security seriously.

Coinbase Security Infrastructure

Cold storage: 98% of customer funds stored offline

FDIC insurance: Up to $250K for USD balances held in linked bank accounts

Crime insurance: Cryptocurrency holdings covered by commercial crime insurance (not FDIC/SIPC)

Two-factor authentication: SMS, authenticator apps, hardware security keys

Biometric login: Face ID and fingerprint support on mobile

SOC 1 & SOC 2 Type II audits: Third-party security verification through Deloitte & Touche

Security track record: No major breaches affecting customer funds since 2012

Note: A 2021 security incident affected a small number of accounts through SIM-swap attacks. A user-level vulnerability, not an exchange breach. Coinbase reimbursed affected customers.

Coinbase's public company status adds transparency. Quarterly SEC filings provide visibility into operations, though this also means more regulatory scrutiny.

Kraken Security Features

Cold storage: 95% of assets in air-gapped cold storage

Two-factor authentication: Authenticator apps, hardware keys, PGP-signed emails

Global Settings Lock: Prevents account changes for 72 hours

Master Key: Additional account recovery security layer

Security track record: Never suffered a major breach affecting customer funds

Proof-of-reserves: Regular third-party audits published publicly

Bug bounty program: Active security researcher engagement

The 2019 incident everyone cites (wrongly): Kraken has never been directly hacked. However, Kraken's security team discovered vulnerabilities in other exchanges and published their findings. This transparency sometimes gets confused with Kraken itself being breached, which didn't happen.

Insurance and Protection Comparison

Coinbase: Hot wallet insurance, FDIC for USD, crime insurance for crypto, public company oversight providing additional accountability

Kraken: Insurance for custody assets, proof-of-reserves transparency, no FDIC equivalent

Our Verdict on Security

Both platforms maintain institutional-grade security with clean track records. Kraken edges ahead slightly with its spotless history since 2011. But really the security difference is negligible.

Advanced Features Compared

Once you go further than basic buy-and-hold, the platforms diverge sharply. Coinbase keeps things focused on spot trading with some professional tools. Kraken opens up the full playbook of trading products, including leverage and derivatives.

What Coinbase Advanced Trade Offers

Coinbase Advanced Trade gives you proper trading tools without overwhelming complexity. You get real-time order books, limit orders, stop losses, and portfolio analytics. The TradingView integration handles charting with technical indicators for analysis.

API access is available for algorithmic trading and institutional use, though it's more basic than Krakens. Recurring buys help with dollar-cost averaging strategies.

What Coinbase doesn't offer: margin trading, futures, or leveraged products. The platform deliberately avoids complex derivatives that can blow up accounts quickly. If you want leverage, you're looking at the wrong exchange.

What Kraken Brings to the Table

Kraken assumes you want access to everything. Here's what experienced traders get:

Leverage and Derivatives:

Margin trading with up to 5x leverage on spot markets

Futures contracts with up to 10x leverage

Multiple order types: stop-loss limit, take-profit limit, trailing stop, iceberg orders

Options trading on select pairs

Trading Infrastructure:

REST and WebSocket APIs for algorithmic trading

Fully customizable Kraken Pro interface

Deep order book visibility for better execution

Advanced charting with extensive technical indicators

The Real Difference

Coinbase keeps guardrails on. You can trade professionally, but within boundaries designed to prevent catastrophic losses. It's spot trading done well, with good tools and institutional-grade infrastructure.

Kraken removes the guardrails. Want to short Bitcoin on 5x margin? Trade perpetual futures? Execute complex algorithmic strategies? It's all there.

The stock and ETF trading on Kraken is genuinely unique. No other major crypto exchange lets US users trade thousands of traditional securities alongside crypto in one platform. For traders building diversified portfolios, that integration matters.

If you need margin, futures, or want one platform for both crypto and stocks, Kraken is the answer. For professional spot trading tools without the temptation of leverage, Coinbase Advanced Trade delivers what you need and nothing you don't.

Customer Support and Educational Resources

Waiting until something goes wrong and then finding out if the support is good or not isn’t a wise move.

This is what we can tell you:

Coinbase Support

Support channels:

Phone support for urgent account issues

Email support (24-48-hour typical response)

Comprehensive help center and FAQ

Community forums

Social media support

Educational resources:

Coinbase Learn: Video tutorials and interactive lessons

Earn while you learn: Get paid crypto for completing courses

Beginner-friendly content throughout

Limited advanced trading education

Coinbase's phone support option separates it from most crypto exchanges. Being able to talk to a human when money is stuck makes a real difference, especially for newcomers.

The educational content stays accessible. No assumptions about prior knowledge, clear explanations, minimal jargon.

Kraken Support

Support channels:

24/7 live chat (major advantage over Coinbase)

Email support

Comprehensive knowledge base

Community forums (user-driven)

Multi-language support

Educational resources:

Kraken Learn Center: Extensive library covering basics through advanced topics

Market research reports: In-depth analysis

Advanced trading guides: Technical analysis, risk management, strategy

Assumes some baseline crypto knowledge

Kraken's 24/7 live chat wins consistently in user reviews. Response times are faster, and getting real-time help while troubleshooting beats waiting for email responses.

The knowledge base is massive - probably too much for complete beginners, but excellent once you know what you're looking for.

The Verdict on Support and Education

For support: Kraken wins with 24/7 live chat and faster response times

For education: Coinbase wins for beginners, Kraken wins for advanced traders

For phone support: Coinbase is the only option

Geographic Availability and Regulatory Considerations

Where you live might eliminate one of these platforms entirely before you even compare features.

The United States Situation

If you're in New York or Maine, I have bad news: Kraken doesn't operate there at all. Not for trading, not for staking, not for anything. You literally cannot create an account.

Coinbase, on the other hand, secured licenses in all 50 states and holds New York's notoriously difficult BitLicense, so you're covered anywhere in the US.

Both exchanges are registered as Money Services Businesses with FinCEN. Coinbase adds another layer of regulatory oversight as a publicly traded company on NASDAQ - quarterly SEC filings mean you can actually read about their operations and financials. That transparency cuts both ways: more accountability, but also more regulatory scrutiny.

International Reach

Outside the US, both platforms cast wide nets. Coinbase operates in 100+ countries with particularly strong compliance in North America and Europe.

Some features vary by region, staking, for instance, isn't available everywhere but the core trading experience translates globally.

Kraken technically operates in 190+ countries and built especially strong reputations in Europe and Canada. They hold specific licenses in major markets like Japan, France, and the UAE.

However, Kraken has pulled out of certain markets when regulatory requirements became too burdensome. This willingness to leave rather than compromise on their business model means availability can change.

In a nutshell:

If you're a US resident, check your state first; it might make the decision for you.

International users - generally, fees and features become the deciders rather than availability.

Pros and Cons: Coinbase vs Kraken

Coinbase | Kraken | |

✓Pros |

|

|

✗Cons |

|

|

The real question isn't "which is better?" It's "which fits your situation?" Living in New York? Coinbase is your only option here. Trading frequently in Texas? Kraken's lower fees start looking pretty attractive. Just getting started and want hand-holding? Coinbase won't make you feel stupid for asking basic questions.

Still not decided? Why not read our Coinbase vs. Binance comparison.

Final Thoughts: Deciding Between Coinbase and Kraken

Unless you are in a restricted state or country nothing's stopping you from having accounts on both platforms. Plenty of experienced traders use both.

But when you're starting out? Pick one and actually learn it. Bouncing between exchanges while you're still figuring out the basics just makes everything harder.

Coinbase is the obvious starting point for most people. The interface makes sense, you can call someone when you're confused, and you won't accidentally do something stupid like opening a 5x leveraged position. Get comfortable there first.

If you'd rather jump straight in the deep end, Kraken rewards that ambition. You'll save money on fees from the start and get access to way more trading tools. Just know you're signing up for a steeper climb.

Setting up an exchange account takes five minutes.

Actually knowing what you're doing? That's the real challenge.

LearningCrypto turns months of fumbling around into weeks of focused progress. We pair AI-driven education with portfolio tracking and market analysis tools so you're not just clicking buttons - you understand why you're clicking them.

FAQs

Does Kraken offer recurring purchases like Coinbase?

Yes, but Coinbase does it better. Their recurring buy feature is simpler to set up and more reliable for dollar-cost averaging strategies.

Which exchange has more trading pairs?

Kraken offers 700+ trading pairs versus Coinbase's 460+. More crypto-to-crypto pairs means fewer conversions and fees when swapping between altcoins.

Can I earn interest on my crypto on either platform?

Staking, yes. Both offer it (with state restrictions on Kraken). Traditional interest accounts? Neither platform offers those anymore due to regulatory concerns.

Which exchange is better for Bitcoin-only investors?

Coinbase for simplicity, Kraken for fees. If you're only buying Bitcoin and holding, the interface matters less go with Kraken's lower costs.

Do I need to verify my identity on both platforms?

Yes. Both require KYC (Know Your Customer) verification to comply with US regulations. You'll need government ID and proof of address.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.