A Complete Guide to Crypto Margin Trading

Margin trading is borrowing money from an exchange to buy more cryptocurrency than your account balance would normally allow.

Every crypto trader eventually faces the same temptation: watching Solana pump 12% in a day and thinking, "if only I had more capital to work with." Margin trading promises to solve that problem by letting you borrow against your existing crypto to open bigger positions.

But borrowing money to trade cryptocurrency isn't as simple as it sounds. The terminology alone confuses many people.

Margin trading and leverage trading get thrown around interchangeably when they're actually quite different mechanisms. Margin refers to the loan-and-collateral system, and leverage is the multiplier it creates.

We’re going to cut through the confusion to focus specifically on margin trading.

What You'll Learn About Margin Trading

How margin differs from leverage - most people mix these up, but the distinction matters for your trading approach.

Borrowing mechanics from start to finish - account setup, executing trades, and closing positions without liquidation.

Interest costs and hidden fees - the charges that turn profitable trades into losses if you don't plan for them

Conservative strategies for position building - approaches that let experienced traders amplify holdings responsibly.

And more….

What Is Crypto Margin Trading?

At its core, margin trading is all about using borrowed money to buy or sell cryptocurrency. Instead of trading only with what’s in your wallet, you deposit some of your own crypto as collateral, then borrow additional funds from an exchange. The combined amount becomes your total trading position.

Here’s a simple example:

You deposit $1,000 worth of ETH as collateral and borrow another $1,000 from the exchange.

Now you have $2,000 in buying power to purchase crypto. You own whatever you buy with those funds, but at the same time, you owe the exchange $1,000 plus interest.

When you're ready to close the position, you sell the crypto you bought and use the proceeds to repay the loan.

If the trade was profitable, you keep the gains after paying back what you borrowed plus interest. If it was a loss, that loss comes out of your original collateral.

The difference from regular spot trading is that margin introduces extra moving parts: interest charges, collateral requirements, and the risk of a margin call if your account value drops too far.

That added complexity is why it’s considered an advanced strategy, even though the idea is simple - borrow, trade, repay.

The Traditional Finance Parallel

Crypto margin trading works similarly to stock margin trading. On the positive side, it is more accessible, though what’s not so great is that it’s a lot riskier.

In traditional stock markets, you can typically borrow up to 50% of your portfolio value to buy additional stocks. The process involves the same basic mechanics: you put up your existing stocks as collateral, borrow money from your broker, and use those funds to purchase more securities.

The similarities include paying interest on borrowed funds, facing margin calls when your collateral value drops, and the potential for liquidation if you can't meet margin requirements.

The differences become apparent quickly in crypto markets. Traditional stock markets close, giving you evenings and weekends to think about your positions. Crypto markets never sleep, so your margin positions face constant price pressure 24/7.

Volatility levels also differ dramatically. A 2% daily move in the S&P 500 makes headlines. In crypto, 5% swings barely register as noteworthy, and 20% moves happen regularly during volatile periods. This higher volatility means crypto margin calls can happen much faster than in traditional markets.

Margin Trading vs. Leverage Trading

The terms "margin" and "leverage" get tossed around like they're the same thing, but they're actually quite different beasts. One is the method, the other is the result.

Margin Trading Characteristics

Margin trading is basically getting your exchange to loan you money using your crypto as collateral. You walk away owning real cryptocurrency that you bought with a mix of your funds and borrowed money. The exchange charges you interest like any other loan, and you can hold these positions as long as you keep paying that interest.

Most exchanges cap margin trading at relatively sane levels, usually 2x to 5x your account value. Margin trading is the more conservative cousin of leverage.

Leverage Trading Characteristics

Leverage trading typically happens through derivatives contracts, where you're not borrowing anything or owning any real crypto. You're essentially making a bet on price movements through contracts that can go up to 100x your account size.

Instead of paying loan interest, you deal with funding fees that change based on market sentiment. These positions often have expiration dates or automatic closure rules that can cut your trade short, whether you like it or not.

Who Should Pick What?

Margin trading suits people who want to actually own more crypto while taking measured risks. Leverage trading attracts the adrenaline seekers who want maximum bang for their buck on short-term price moves.

Aspect | Margin Trading | Leverage Trading |

What you actually get | Real crypto you own | Just price exposure |

Typical multipliers | 2x-5x | Up to 100x+ |

How you pay | Interest on borrowed funds | Funding fees that fluctuate |

Position duration | As long as you pay interest | Limited or auto-closes |

Risk profile | Comes with risks but lower | Much higher, liquidation can be instant |

Read our What is Leverage Trading? Guide Here

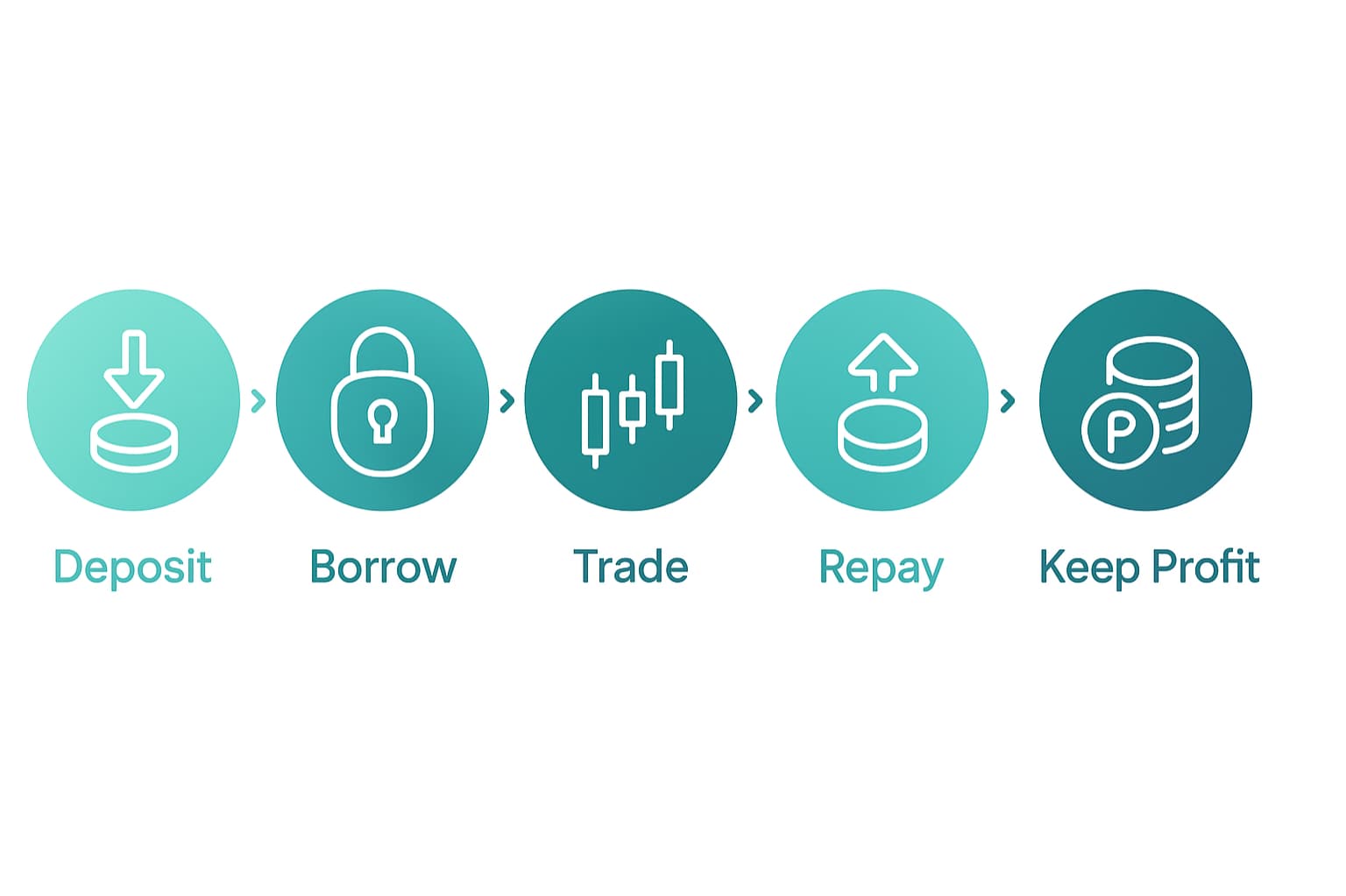

How Crypto Margin Trading Works: Step-by-Step Process

Margin trading follows a straightforward cycle.

Here’s what happens from setup to settlement.

Setting Up Your Margin Account

Step one is to enable margin trading on your exchange. This usually requires additional verification beyond regular spot trading. Most platforms want to confirm you understand the risks before letting you borrow their money.

You deposit collateral - typically major cryptocurrencies like Bitcoin or Ethereum, or stablecoins like USDT. The platform calculates your borrowing power based on what you've deposited. Better collateral usually means better borrowing terms.

Each exchange has different minimum balance requirements, often ranging from $1,000 to $10,000 to access margin features. Some platforms let you start smaller, but you'll have limited borrowing capacity.

Executing Your First Margin Trade

Here's the actual process:

Choose your collateral: Deposit crypto that will secure your loan.

Calculate your borrowing: Decide how much to borrow based on your risk tolerance. More borrowing means more potential profit, but also higher liquidation risk.

Place your trade: Use the combined funds (yours plus borrowed) to buy cryptocurrency. This works just like regular trading, except with more buying power.

Monitor ongoing costs: Interest starts accruing immediately and compounds daily. Keep track of these costs as they eat into your potential profits.

Close and settle: When you're ready to exit, sell your crypto and repay the loan plus interest. Any remaining funds are yours to keep.

Ratios and Limits

Initial margin: the portion of the trade you must provide upfront.

Maintenance margin: The minimum collateral level required to keep your position open. If your collateral value falls below this threshold due to adverse price movements, you'll receive a margin call.

Margin call: serves as a warning when your collateral falls below maintenance requirements. You'll typically have a short window to add more collateral or reduce your position size to avoid liquidation.

Choosing an Exchange for Margin Trading

If you’re already in the crypto game, you’ll probably start margin trading on an exchange where you keep funds.

But exchanges do differ; some go for a more regulated experience with a handful of major coins, while others throw open the doors to dozens of altcoin pairs with higher borrowing limits and higher risks.

Margin Trading on Major Centralized Exchanges

Binance offers one of the most comprehensive margin setups with cross-margin and isolated margin options. Cross-margin pools all your collateral together, while isolated margin keeps each trade separate. They support dozens of margin pairs with competitive rates, but their liquidation engine can be ruthless during volatile periods.

Kraken takes a more conservative approach, with stronger customer protections and clearer policies. Margin requirements are stricter. You're less likely to be blindsided by sudden policy changes or aggressive liquidations. It’s a good choice for beginners who want predictable rules.

Coinbase offers limited margin trading in select regions with higher fees but better regulatory compliance. If you prioritize working with a publicly traded, well-regulated company, taking on those extra costs could be a smart move.

What to Compare Before Choosing

Available pairs and limits vary dramatically. Some exchanges let you margin trade obscure altcoins, while others only allow you to stick to major cryptocurrencies. Check what you want to trade before opening an account.

Interest rates and fee structures can make or break your profitability. Rates can fluctuate based on supply and demand, so what looks cheap today might be expensive next week during high borrowing demand.

Liquidation policies determine how much warning you get before positions close. Some platforms give you breathing room and advance notices, while others liquidate positions aggressively to protect themselves.

Security track record will matter when you're putting up collateral. Exchanges with poor security histories or regulatory issues pose risks other than just normal trading losses.

DeFi Alternative

DeFi platforms let you borrow from lending pools using smart contracts instead of centralized exchanges. You maintain control of your wallet throughout the process - no depositing funds to exchange custody.

Interest rates fluctuate constantly based on pool utilization across networks. When borrowing demand spikes, rates can jump from 5% to 50% overnight. There are no margin calls - smart contracts automatically liquidate positions when collateral ratios drop below thresholds.

You'll also manage multiple transactions yourself, so it can get complex. You will deposit collateral, borrow funds, execute trades, and repay loans separately.

With DeFi trading, rates are better, and custody control is in your hands. However, it requires more technical knowledge and involves smart contract risks instead of exchange counterparty risk.

Margin Trading Strategies and Best Practices

There’s no single “winning” strategy for margin trading. Still, there are a few common approaches and ground rules that separate smart margin traders from reckless ones.

Conservative Approaches

Margin doesn’t have to mean high-risk speculation. Some traders use it more cautiously.

Scaling into majors

Using margin to hold larger positions in major cryptocurrencies represents one of the safest approaches to margin trading. By borrowing against your Bitcoin to purchase more Bitcoin or other established cryptocurrencies, you can amplify your exposure to assets you already believe in long-term.

Buying dips

Dollar-cost averaging with borrowed funds during market dips can be effective, but it requires careful position sizing and adequate reserves. This strategy works best when you are highly confident in the long-term direction of your chosen assets.

Hedging

Hedging existing spot positions with opposite margin trades to lock in profits or limit losses without selling your underlying holdings. For example, if you own Bitcoin and expect a short-term downside, you could margin-short Bitcoin to offset potential losses.

Short-term trades

Trading with quick position closures minimizes interest costs by keeping borrowing periods brief. This approach works well for traders who can dedicate time to active position management.

Monitoring and Risk Controls

Successful margin trading requires constant vigilance without turning into an obsessive chart-watcher.

Set up automated alerts for price movements and margin ratio changes. Most platforms offer customizable notifications that warn you before approaching liquidation levels. Configure alerts at multiple levels - when your margin ratio drops to 75%, 50%, and 25% of safety limits.

Use position tracking tools beyond your exchange's basic interface. Spreadsheets or portfolio tracking tools help monitor total exposure across multiple positions and platforms. Track your liquidation prices, daily interest costs, and break-even points for each trade.

Establish monitoring routines that don't consume your entire day. Check positions at market open, mid-day, and before sleep rather than constantly refreshing. Crypto markets never close, but you need rest and mental clarity to make good decisions.

Create emergency procedures for adding collateral quickly. Have backup funds readily available and practice the deposit/transfer process during calm periods. Know exactly how long transfers take and what minimum amounts your platform accepts.

Risk Management Essentials

The biggest mistake in margin trading is thinking borrowed money behaves the same as spot funds. It doesn’t. To stay in the game:

Borrow conservatively – Avoid maxing out your borrowing limit.

Set stop-loss orders – They’re not perfect in crypto, but they help cap damage.

Check positions daily – The market doesn’t sleep, and neither do margin risks.

Keep reserves – Having spare collateral ready can save you from forced liquidation.

Common Margin Trading Mistakes

Holding positions too long and paying excessive interest turns potentially profitable trades into losers. Always factor interest costs into your profit calculations and have a clear timeline for your trades.

Using maximum borrowing capacity without safety buffers leaves no room for adverse price movements. Keep some borrowing capacity in reserve to add to positions or post additional collateral if needed.

Margin trading with money you can't afford to lose violates basic risk management principles. Only use funds that won't impact your financial security if lost completely.

Ignoring funding costs when calculating potential profits leads to unrealistic expectations. When evaluating trade viability, factor in all costs, including interest, trading fees, and opportunity costs.

Treating margin trading like spot trading with relaxed risk management ignores the heightened risks that borrowed money introduces to your positions.

Costs and Fees in Crypto Margin Trading

Margin trading isn’t free money. Beyond the risks of price swings, there are plenty of costs that eat into your returns. Understanding them upfront can save you from nasty surprises.

Interest Rate Structures

Every exchange charges interest on borrowed funds, but how they calculate it varies. Some apply daily rates, others by the hour. Rates are almost always variable. When borrowing demand is high, costs can climb quickly.

In crypto, interest rates are often steeper than in traditional finance because of volatility and looser regulation. For in-demand coins, borrowing can even spike to 1–2% per day during extreme market conditions.

Hidden Costs to Watch Out For

Trading fees – Margin positions usually cost more than spot trades, and the fees scale with your position size. Double your position, and you’re effectively doubling your fees.

Liquidation fees – If your position is forcibly closed, expect an extra hit of 0.5% to 2% on top of your losses.

Funding and withdrawal costs – Holding positions for a long time can rack up funding rates, and some platforms tack on withdrawal fees as well.

Opportunity cost – Collateral locked in a margin wallet can’t earn staking rewards or be used elsewhere while you’re trading on margin.

Calculating the Total Cost

A simple way to estimate your costs is:

(Interest × Days Held) + Trading Fees + Spread Costs + Potential Liquidation Fees

Run this calculation before opening a trade to see how far the price needs to move in your favor just to break even. Many traders discover that margin works better for short-term opportunities, since interest adds up fast the longer you hold.

Legal and Tax Considerations for Margin Trading

Margin trading isn’t available everywhere. Some countries allow it under strict limits, others ban it outright. Always check what’s permitted in your region before opening a margin account. Exchanges may restrict access based on your location.

On the tax side, the rules are the same as with any other crypto trading: gains are taxable, losses may be deductible, and you’re responsible for keeping records.

Interest paid on borrowed funds can sometimes be treated as an expense, but this depends on local laws.

The bottom line? Assume tax applies, and speak with a professional if you’re not sure how margin trades fit into your reporting.

Margin Trading in Perspective

Margin trading isn’t the wildest corner of crypto. Compared to 100x leverage bets or chasing meme coins, it can look fairly sensible. You’re borrowing against assets you already own, paying interest, and managing positions that, in theory, you can hold as long as you stay on top of your collateral.

But “not the worst” doesn’t mean “risk-free.” Interest costs add up, markets move faster than you expect, and margin calls don’t wait for you to catch your breath. If you want to try margin, do it with caution and risk management rules in place.

The difference between reckless margin trading and responsible margin trading is knowledge.

LearningCrypto brings together expert insights, AI-powered education, smart tools, and a trader community that learns together. Take control of your trading future - join us today.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.