Is Pi Network Legit or Hype? Comprehensive Expert & Honest Analysis

In the ever-evolving world of digital assets, few projects have sparked as much curiosity, controversy, and debate as Pi Network. Launched on Pi Day, March 14, 2019, by Stanford graduates Dr. Nicolas Kokkalis and Dr. Chengdiao Fan, Pi Network promised a bold vision: Build the world’s most inclusive peer-to-peer ecosystem and online experience, fueled by Pi, the world’s most widely distributed cryptocurrency.

Unlike Bitcoin or Ethereum, which demand significant computational resources, Pi claimed that anyone with a smartphone can help in building a decentralized economy by simply tapping a button once a day. The simplicity of the idea resonated with the masses. The app had attracted over 60 million users globally, making it one of the largest grassroots crypto movements to date.

However, behind this viral success lies a growing list of concerns. Critics have questioned the project’s centralized structure, unclear tokenomics, and referral-driven growth model. Despite six years of development, most users still cannot access or trade their Pi holdings. The network’s open mainnet only launched on 20 February 2025, and its availability on major exchanges remains limited.

In this blog, we will help you provide a balanced analysis that helps you decide whether this project is a legitimate innovation in blockchain or simply an experiment wrapped in hype.

So let us get started!

What is Pi Coin?

Pi Network was developed by a team of Stanford alumni led by Dr. Nicolas Kokkalis and Dr. Chengdiao Fan. It aimed to solve two of the biggest issues facing traditional cryptocurrencies: accessibility and energy consumption. The Pi mobile app allows users to "mine" Pi by simply pressing a button once a day. There is no actual computation involved, so there is no battery drain or data usage.

The Pi system relies on a trust-based consensus model known as the Stellar Consensus Protocol (SCP). Rather than validating transactions using computational power like in Proof-of-Work systems, Pi users form security circles by adding trusted contacts. These connections form a global trust graph that serves to validate and secure the network.

The network’s growth unfolded across four main stages:

Phase 1 (2019-2021): Beta testing, focused on user acquisition through its mobile app's "mining" simulation.

Phase 2 (2021-2023): Testnet development, allowing users to run nodes on their computers and test transactions.

Phase 3 (2023-2025): Enclosed Mainnet, launched in December 2021, with a firewall preventing external connectivity. This period focused on KYC completion and ecosystem development.

Current Phase: Open Mainnet (Launched February 20, 2025): The most significant milestone, removing the firewall and theoretically enabling external wallet transfers, exchange listings, and broader utility.

How Pi Network Works

As mentioned earlier, the Pi Network employs a unique consensus mechanism setting it apart from traditional cryptocurrencies like Bitcoin’s proof of work or Ethereum’s proof of stake.

Consensus Mechanism: Stellar Consensus Protocol (SCP) Adaptation

The Pi Network uses a modified Stellar Consensus Protocol (SCP), a type of Federated Byzantine Agreement (FBA) that enables trust-based consensus. Users create “security circles” of 3–5 trusted individuals, which collectively help secure the network and prevent fraud without heavy computation. SCP offers energy efficiency and speed, but it's decentralization depends on how validator nodes are distributed and operate independently.

The "Mining" Process

Pi Network's "mining" is fundamentally a daily engagement mechanism, not traditional cryptographic mining. Users can open the Pi app once every 24 hours and tap a button to confirm their presence. This action "earns" Pi coins at a base rate, which can be boosted by:

Security Circles: Adding 3-5 trusted users to a security circle increases the mining rate.

Referral Teams: Inviting new users through a referral code (Ambassador role) provides a 25% bonus on the base mining rate for each concurrently active invitee.

Node Operation: Running the Pi Node software on a desktop computer. Here is how you set up a Pi Node:

This system is designed to incentivize network growth and user engagement, rather than solving complex computational puzzles.

Security in Pi Network: Promise vs. Practice

Security is one of the cornerstones of any credible blockchain project. In theory, Pi Network integrates several standard security mechanisms to protect its users and infrastructure. However, a deeper analysis reveals a sharp disconnect between these features on paper and their actual implementation in the current network structure.

Pi Network uses standard security tools like cryptographic data protection, multi-factor authentication, and blockchain-based verification. These aim to protect users and ensure transaction integrity.

The network runs on the Stellar Consensus Protocol (SCP), a trust-based model designed to be energy-efficient and secure. It avoids energy-intensive mining by relying on trusted relationships between nodes.

Despite its claims, Pi’s validator structure remains centralized. Although Pi states it has over 200,000 nodes, these mostly include passive or observer nodes. Actual consensus-participating validators are far fewer.

Mainnet’s validators are controlled by the core team, undermining decentralization and increasing the risk of censorship and system manipulation.

Independent verification of validator data is lacking. Unlike Ethereum or Solana, Pi does not offer public dashboards or third-party analytics to confirm validator activity.

Pi Scan Explorer shows only 28 nodes and three validators, which is inadequate for a global blockchain project. This raises doubts about scalability and resilience.

The system behaves more like a permissioned network, where control is limited to a small group. This is a mismatch with its image as a decentralized cryptocurrency for the masses.

While Pi Network has implemented security protocols on the surface, its centralized validation model and lack of transparency raise serious concerns. Until these issues are addressed, its claims of decentralization remain questionable.

Controversy and Critics

The journey of Pi Network has been fraught with controversy, drawing both fervent support and sharp criticism.

Lack of Transparency

A persistent criticism against Pi Network is its perceived lack of transparency in key areas:

Vague Tokenomics: The total supply is capped at 100 billion Pi, but distribution details remain unclear. The Pi Foundation reportedly controls over 90 billion tokens across about 2,000 wallets, raising concerns about centralization. While the team calls this a temporary strategy, no timeline for decentralizing control has been shared.

Centralized Control of Nodes: Despite claims of hundreds of thousands of nodes, the number of independent validators on the Mainnet remains extremely limited and appears to be managed mainly by the core team.

Development Delays: Pi Network's Mainnet launch was postponed multiple times over several years. These delays have led to growing frustration among users and doubts about the team’s ability to deliver.

Pyramid Scheme Allegations

Pi Network has faced strong criticism for resembling a pyramid or multi-level marketing scheme. The platform heavily relies on user referrals to boost mining rates, rewarding those who bring in new participants rather than those who contribute utility.

Referral-Driven Growth: Mining rates increase based on the number of active invitees, encouraging recruitment over real network value.

Expansion Over Utility: For years, user acquisition was prioritized while ecosystem development lagged behind.

Regulatory Warnings: China and Vietnam have flagged Pi for pyramid scheme traits, citing benefits to early users through recruitment. While this aligns with the FTC’s definition, no formal action has been taken by Western regulators.

Pi Network argues it is not a scam since no upfront payment is required and value will come from adoption. However, critics point to indirect monetization through ads and user data collection, which complicates the project’s claim of being purely user-focused.

Limited Utility and Liquidity

Even after the Open Mainnet launch, Pi Coin continues to face major hurdles in usability and liquidity.

Exchange Accessibility: Pi is listed only on lesser-known exchanges like OKX and Gate.io, with no presence on major platforms like Binance or Coinbase, limiting trust and access.

Weak Liquidity: Low trading volume and high volatility make it hard to trade Pi without incurring losses from price swings.

Withdrawal Issues: Most Pi is locked pending KYC and Mainnet migration. Users report delays and technical problems, limiting control over funds.

Limited Real-World Use: Despite promotional efforts, verified merchant adoption is scarce, and most usage remains within Pi’s closed ecosystem. New tools are too early to assess.

Mandatory KYC & Privacy Concerns

To access their "mined" Pi tokens and migrate to the Mainnet, users are required to undergo Know Your Customer (KYC) verification. This typically involves submitting sensitive personal information, including government-issued IDs and facial recognition data, to third-party KYC providers.

High Data Collection: The Pi app requests extensive access (contacts, location, microphone, storage), raising privacy concerns despite claims of compliance needs.

Alleged Data Breach: A 2021 breach in Vietnam exposed 17GB of user data. Pi denied direct responsibility, citing a third-party vendor, highlighting accountability gaps

Limited Security Audits: Aside from a vague 2023 audit by “Cerick,” no reports from top-tier security firms have been released, leaving data protection unclear.

Is Pi Network Legit or a Scam?

Pi Network occupies a gray area, making a definitive "legit" or "scam" label difficult. It is not a traditional scam in the sense of a direct Ponzi scheme that requires upfront financial investment from users. Participation is "free" in terms of money, demanding only time and attention.

Arguments for Legitimacy (or Potential):

Founded by Stanford-educated individuals with verifiable academic and professional credentials, lending credibility to the project

No upfront financial investment required to mine Pi, reducing user risk

Mainnet is live, and a functional blockchain explorer is publicly available

Ecosystem initiatives like PiFest, Map of Pi, and Pi App Studio show development efforts, though mostly within the internal community

Arguments Against Legitimacy (or Significant Concerns):

Heavy reliance on referrals mirrors MLM structures, drawing regulatory scrutiny

Mining is engagement-based, not tied to actual blockchain validation

Centralized token control and unclear validator distribution challenge decentralization claims

Real-world utility and easy exchange access remain limited after six years

Unclear tokenomics and repeated delays continue to fuel skepticism

Extensive data collection, mandatory KYC, and alleged breaches raise privacy concerns

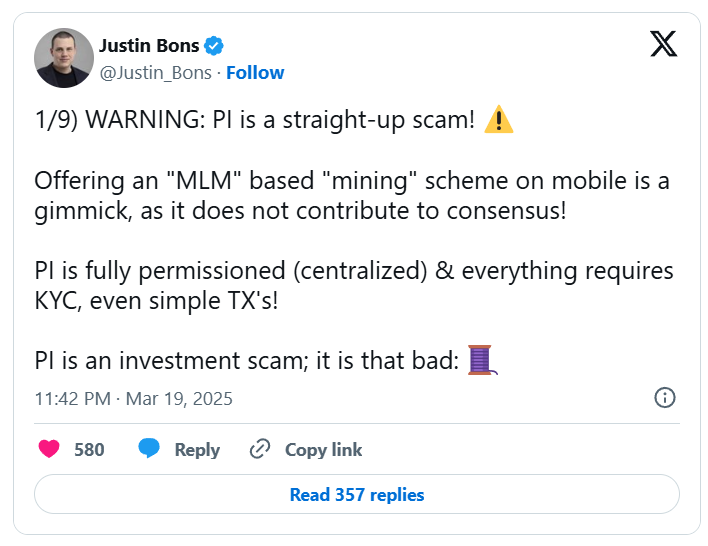

Source: Twitter thread on Pi Network

Future of Pi Coin

The future of Pi depends on whether it can evolve from a speculative, referral-driven project into a decentralized cryptocurrency with real utility and adoption.

Price: As of June 2025, Pi trades around $0.53 to $0.57. These prices are driven by low-liquidity IOU markets. Without strong use cases or listing on major exchanges, the price remains volatile and unstable.

Development Roadmap: Post-Mainnet goals include network upgrades, enhanced security, improved scalability, and ecosystem growth. These initiatives aim to encourage real-world applications.

Core Challenges: The key hurdle is creating real utility beyond the internal Pi ecosystem. Most current apps are community-led and lack the scale or compliance needed for broader adoption.

Regulatory Risks: Pi’s model raises potential regulatory concerns due to unclear tokenomics and centralized control. While KYC requirements show an effort toward compliance, its legal classification is still uncertain in many countries. Future enforcement actions could pose serious risks.

Conclusion

Pi Network represents an ambitious attempt to democratize cryptocurrency access through mobile "mining," successfully building a massive global community. However, its journey is overshadowed by persistent controversies. While not a traditional financial scam, it exhibits concerning characteristics: a pyramid-like referral structure, misleading "mining" claims, opaque tokenomics with centralized control, and a significant disconnect between its claimed user base and verifiable utility or liquidity.

Many users still cannot freely access or trade their "mined" Pi, and there's a troubling lack of transparency regarding core decentralization metrics like independent validating nodes. These issues raise serious questions about user control and the project's long-term viability.

The ultimate test for Pi Network's legitimacy lies in its ability to deliver genuine, widespread utility beyond its internal ecosystem and to achieve transparent decentralization, granting users true autonomy over their assets.

Until then, Pi Network remains a highly speculative and controversial project, a long-running social experiment with uncertain returns. Pioneers should maintain a cautious and realistic perspective on their "mined" Pi. For ongoing updates on Pi Network and to deepen your understanding of crypto concepts, Learning Crypto is a valuable crypto online resource for you to start.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk; you should always do your own research before making any investment decisions.