Let's first take a look at the current market.

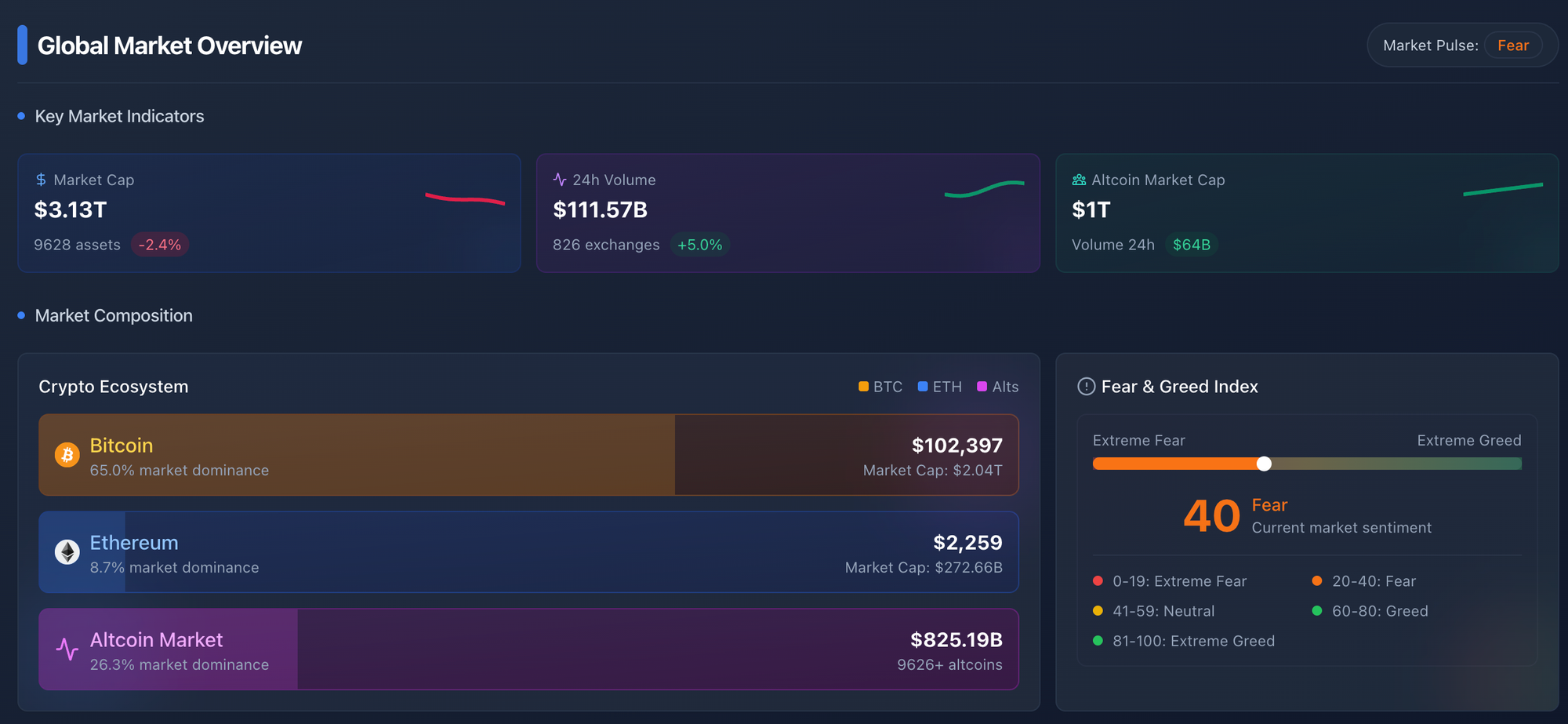

Glancing at this week’s dashboard, the total crypto market pulled back a bit to about $3.13 trillion (down 2.4%), even though traders got busier—24-hour volumes actually jumped 5% to $111.6 billion.

Bitcoin is still in full control with 65% dominance and expect that to remain strong during these turbulent times (around $102 K per BTC), Ethereum is holding its ground at 8.7% (roughly $2,259), and the rest of the altcoins make up about 26% of the pie with a $1 trillion market cap.

Sentiment’s leaning toward fear right now—the Fear & Greed Index sits at 40, which is a drop from around 70 over the last few weeks!

Bitcoin Dominance

With the current global climate it's not a surprise to see Bitcoin dominance continuing to climb.

As we pointed out in the past, historically Bitcoin dominance has topped out around 70%.

The chart here is displaying Bitcoin dominance using Heikin Ashi candles. You can see from this that we've been in a strong uptrend since around 2023.

Think of Heikin Ashi candles like a “smooth” version of regular candlesticks—they average out the open, high, low and close so you see cleaner trends and fewer random spikes. Clearly showing the dominant uptrend we've been in.

Expect this to continue to climb until there is more stability in the macro environment. This is why we always keep a Bitcoin heavy portfolio.

How Will The Current Climate Affect Crypto?

I'm sure you're aware of what's happening in the world right now in regards to World War 3 and I don't want to put too much attention on this topic. But understand that many of you may be concerned with how it could affect crypto.

The truth is, it can affect the markets. But only short term.

What's going on right now just shows exactly why we need crypto and a world that gives equal opportunities for everyone, with no restrictions on access because of who you are or where you come from.

There is no stronger technology right now, just think about it for a moment. ANYONE has access to it 24/7, no middlemen. Nothing.

And they know, their time is running short. They're no longer needed.

We're in this awkward transition phase of moving away from the legacy FIAT world into a new era that's powered by decentralized blockchain technology.

And I don't want this to seem like a shameless plug off the back of a dark situtation but there really is no more appropriate time to read Heidi's book "Why Crypto" if you haven't already.

Project Spotlight: GIZA

Now we all thought the great pyramids were built by Aliens, but did you know they were actually built by AI Agents? Just kidding.

With the dawn of the stablecoin era approaching, there are some interesting AI Agent projects starting to appear. Giza is just an example of one of them that recently came to our attention.

Currently it's sitting around $13m market cap so it's an incredibly high risk and new project.

What Do They Do?

So the idea behind these agents, not just Giza specifically, is that they utilize AI to try and bring you the best yield on your crypto.

So under the hood, they seek out a platform like AAVE where they can deposit your crypto for you and earn a yield on that.

And the agent will be actively seeking the highest returns and move the crypto around automatically when it spots an opportunity.

Now it's quite obvious that this is high risk as you have to essentially hand your crypto over to a smart contract that is controlled by the agent, but it's an interesting and novel idea nontheless.

Navigating Altseason

We’ve also put together a brand new video breaking down our full framework for navigating Altseason 2025—what to expect, how to position, and where we see the biggest opportunities.

Given the sensitivity of current global events, we’ve decided not to share this publicly just yet. Instead, we’re making it available exclusively to members as a private resource to study and prepare at your own pace.