First off we've had an absolute circus on X with Donald Trump and Elon Musk bickering between each other. The only thing this does it cause uncertainty across the U.S. markets, but that once again reiterates the need for Bitcoin and decentralized cryptocurrencies.

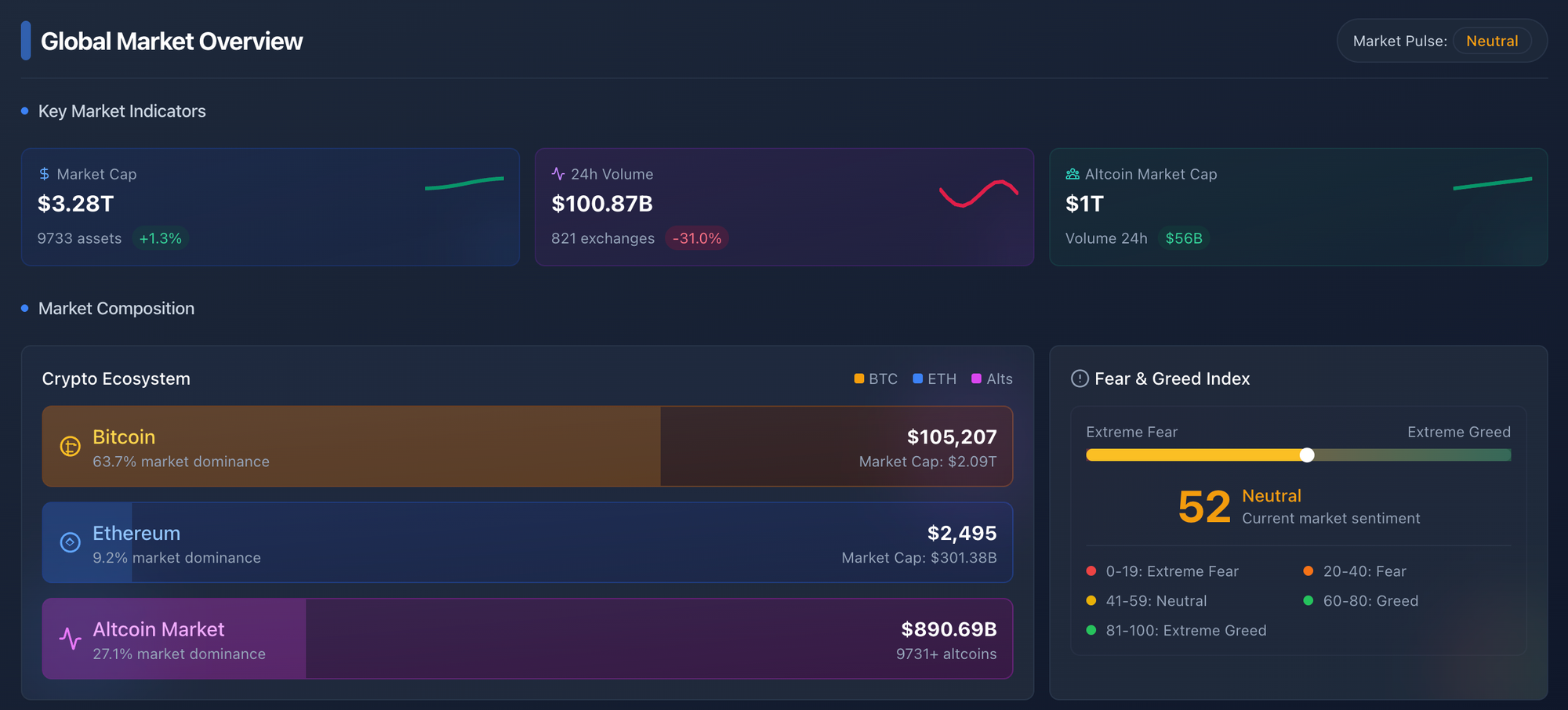

Anyway, let's take a look at the market as it stands today and some interesting highlights over the week. And as we enter towards the final stages of this bull market, you need to consider your finances and optimizing your life ready for this.

ETH/BTC

Ethereum against Bitcoin is the key pair to keep an eye on currently, and there are some interesting flows happening that are certainly giving some strong signals for the rotation into a true altseason.

Let's take a look at the chart first, then we'll cover some of the interesting stats behind it.

You can see ETH bounced on its BTC pair at the previous lows from August 2019, a strong bounce too. This is a great signal that the pair has finally bottomed out and we could be in for the rotation into altseason. However, it would not be surprising to see the pair retest some of the previous levels like it did the previous time too. Either way, it's a strong sign that the bottom is in for now.

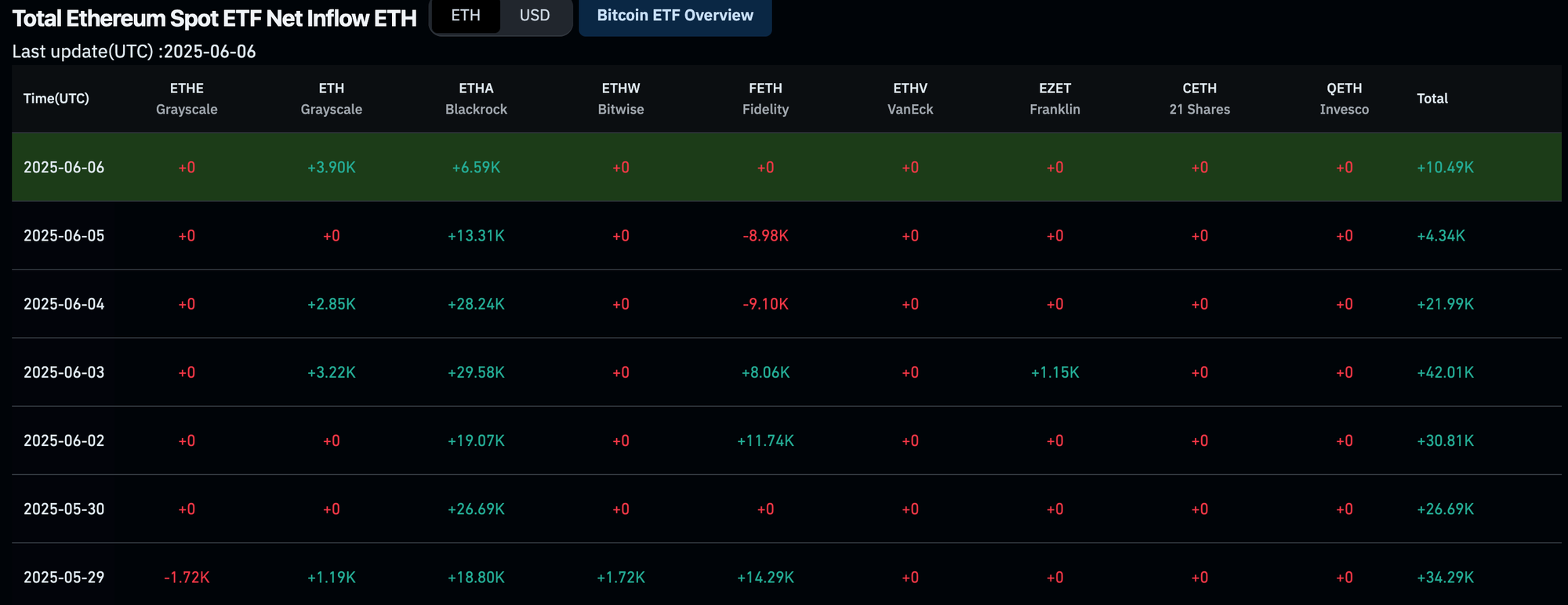

Now, one of the most intriguing things that has been happening over the last week is the inflow/outflows of ETFs.

First, let's take a look at the Bitcoin ETFs. You can see that since 29th May the institutions have been selling into this Bitcoin strength as there has been an overall net outflow of around 10,000 BTC (-$1 Billion).

However, the interesting thing which has not been seen yet so far in this cycle is that whilst they've been selling Bitcoin, they've been accumulating ETH.

Ethereum ETFs: +170 620 ETH (≈ +$426 055 202)

Now, the Ethereum ETFs are still much smaller overall than the Bitcoin ETFs but it's certainly intriguing as we edge closer to the latter stages of the bull market.

Bull Run Tax Preparation

One key aspect to a bull run is ensuring you are prepared properly for tax optimization and ensuring you have your lifestyle goals set for the years to come. If you're not careful, you can end up with a large bill that you was not quite expecting and wipe away a lot of your gains.

On the flip side though, if you're setup properly then you can reduce that burden significantly, in some cases to zero. That requires careful planing and in some cases second citizenships too.

But if you're interested in getting a second citizenship or you're a high net worth individual looking to optimize your setup then feel free to reach out to our team with the button below.

Australian Unrealized Gains Tax

Another alarming thing that seems to becoming more common is unrealized gains taxes, which Australia is set to implement. This is why we consistently remind people the importance of second citizenships and ensuring you are structured in a way that you do not need to rely on one single point of failure (Government).

Palantir Mega API

Now to bring you onto something that's not getting too much attention at the moment, Palantir are working with the U.S. government to create a Mega API.

This is going to be a centralized database that utilized AI to track U.S. citizens spending, tax bills and many other things that goes on in their day to day life.

This is definitely moving towards a social credit score style of system, especially when you combine that with the current stablecoin push. It's definitely not something to ignore, check out this weeks video from Toby on the subject.