Those who were bearish at $74k are bearish again right now, which way will the wind blow?

Market Snapshot

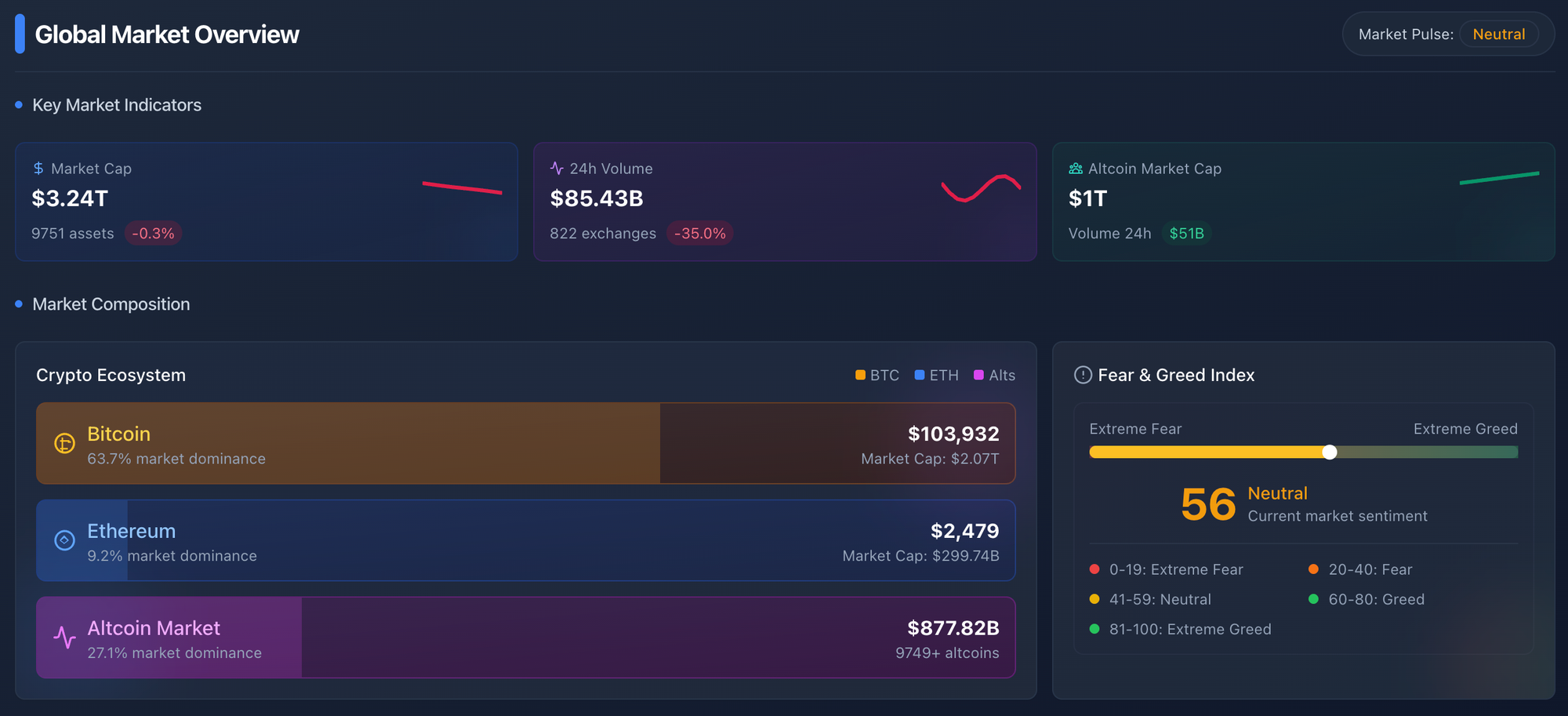

The crypto market is treading water: total capitalisation sits at $3.24 T (-0.3 % WoW) while 24-hour turnover has slumped 35 % to $85.43 B, signalling low-conviction consolidation.

Bitcoin still dominates, commanding 63.7 % of market value at roughly $104 K (cap $2.07 T), with Ethereum a distant second at 9.2 % and $2,479. Altcoins collectively weigh in at $1 T—about 27 % of the pie—but inflows are thin.

The Fear & Greed Index prints a neutral 56, echoing the on-chain standoff: no capitulation, no FOMO. Liquidity is light, sentiment muted and Bitcoin’s share rising—conditions that often resolve in a decisive breakout move.

Bitcoin Price Trends

This short term holder realized price chart shows that short‐term holders’ average cost basis (STH‐RP) has risen to roughly $95.9K, while the 111‐day and 200‐day simple moving averages sit at about $91.8K and $94.3K, respectively.

Bitcoin’s spot price is now comfortably above all three levels, meaning most recent entrants are firmly in profit and longer‐term momentum is bullish. In particular, the fact that price is trading above both the 111- and 200-day SMAs suggests broad support in the $91–94K zone, and it also implies that a pullback below $95 K would be the first time short-term holders would shift into net loss territory since November.

Overall, this alignment of moving averages underpins the bullish market we are still in: as long as BTC stays above these moving averages, short‐term holders are unlikely to capitulate, reducing selling pressure and increasing the odds of further upside.

Exchange Reserves

Bitcoin held on exchanges has steadily declined from roughly 3.3 million BTC in mid‐2023 to about 2.5 million BTC today—its lowest level in years. Over the same period, BTC’s price has climbed from under $30 K to above $100 K, underscoring a significant outflow of coins from exchange wallets into long‐term storage.

The supply is thin and the buyers are heavy, the only thing to be weary of is paper Bitcoin.

Paper Bitcoin

One of the leading concerns for this cycle is the issuance of paper Bitcoin. There has been relentless buying from big institutions including another one that should appear tomorrow by Strategy, as Saylor tends to post about their holdings the day before a purchase.

Orange is my Preferred Color pic.twitter.com/rc9JIcJOAT

— Michael Saylor (@saylor) June 1, 2025

Take note that the buys have become significantly larger has the price of Bitcoin has increased, their average cost basis is skyrocketing.

But the scary part to this cycle is the bubble that's being created through leverage and these wall street giants not willing to prove their true holdings. If paper Bitcoin is being issued, we could be in for a terrible bear market.

I asked @saylor if @MicroStrategy has any plans to publish on-chain proof of reserves

— Mitchell ✝️🇺🇸 (@MitchellHODL) May 27, 2025

His answer will SHOCK you

“It’s a bad idea.”

- Security Risk

- Irrelevant without also having Big 4-audited liabilities

Check it out 👇 pic.twitter.com/tIxUckgbEp

El Salvador are willing to post their holdings, so why not Strategy?

And you DON'T want to miss todays video